Weighted Average Cost of Capital Defined

Organizations have a few options available when it comes to finding funding for their operations. From debt options such as taking out loans or offering long-term corporate bonds to equity such as preferred and common stock, larger organizations tend to find a balance between these options that is optimized for the best possible weighted average cost of capital (WACC) to operate at the scale that creates the best revenue opportunity.

In short, the WACC is a measure of what all of these capital inputs will cost the organization in terms of an average interest rate.

Why Calculate WACC?

WACC is a useful calculation, as it shows management what the cost of borrowing capital is overall. This overall cost of capital can then be a minimum required return on any new operation. For example, if it will cost 8% in capital costs to fund a project that creates 10% in profit, the organization can confidently borrow capital to fund this project. If the project would only turn 8% profit, the firm would have a difficult decision. If the project would turn 6% profit, it is quite easy to strategically argue against the new project.

How to Calculate WACC

Calculating the cost of capital is actually quite a simple equation. Most firms are only receiving from either debt or equity (though there can be quite few inputs to each of these subheadings). What this means is that the overall percentage of the business that is funded by debt (MVd/MVd + MVe) must be multiplied by the cost of debt (Rd), while similarly the percent funding of equity (MVe/MVd + MVe) must be multiplied by the cost of equity (Re) and added together. This can also be applied to the corporate tax rate in a given country of operation. This is written out as follows:

The cost of debt is usually fixed, based on the terms of a given bond or loan contract. As a result, the cost of debt is usually both certain and predictable. The cost of equity is a little bit more complex, as it is speculative and often determined (to some degree) by investor behavior. The capital asset pricing model (CAPM) is a traditional approach to determining the cost of equity:

Each of the variables here are defined as:

- Es - expected return

- Rf - expected risk-free return

- βs - sensitivity to market risk

- Rm -historical return

- (Rm – Rf) - risk premium of market assets over risk free assets.

By calculating the estimated cost of equity, and applying that to the WACC equation with the cost of debt and capital structure, organizations can determine the cost of capital (and thus the required return on projects/assets).

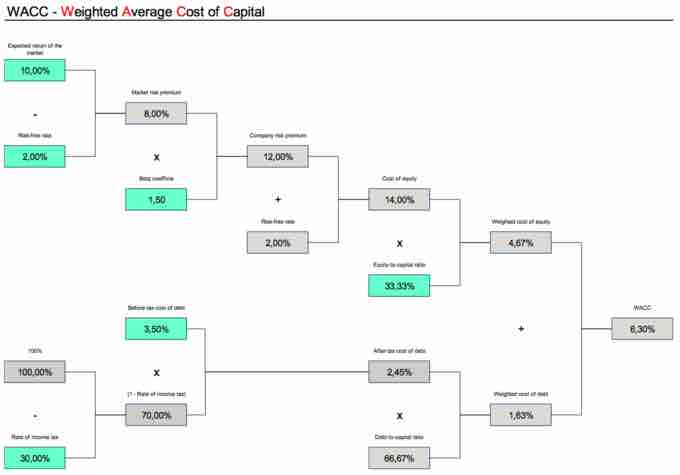

Weighted Average Cost of Capital Tree

This diagram is an excellent illustration of how various forms of debt and equity consolidate into broader calculation of debt and equity overall, and how those can combine as a total weighted average cost of capital.