Section 4

The WACC

By Boundless

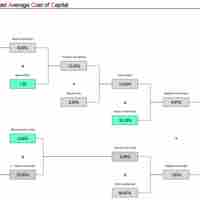

The weighted average cost of capital (WACC) is a calculation that reflects how much an organization pays in interest when acquiring financing options.

The weightings used in the WACC are ratios of the market values of various forms of debt and equity used in a company's financing.

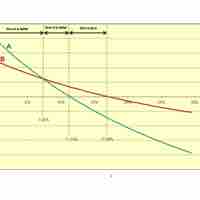

Decisions about capital structure (ratio of debt and equity) alongside projecting rates of return can give firms some internal control over capital costs.

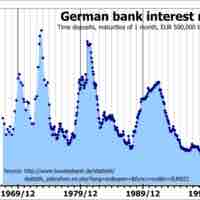

The weighted average cost of capital is vulnerable to market risks, interest rate changes, inflation, economic factors, and tax rates.

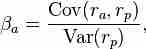

New projects sometimes require taking on risks outside of a company's current scope, resulting in the need to adjust risk in the WACC.

Problems arise in calculating components of WACC because differing methods and proxy values result in widely varying costs of capital.