Making Risk Adjustments

The weighted average cost of capital is the minimum return that a company must earn on an existing asset base. This means that, when calculated, WACC will produce a rate equivalent with the current level of risk present in a company's activities. However, some new ventures will require taking on risks outside of the company's current scope.

In this case, adjustments will need to be made to the WACC in order to account for the differing level of risk. If the risk is very different, the company's current WACC may be sidestepped altogether in favor of a WACC typical for companies with similar investments. It is possible to make such adjustments by figuring the differing risk into the company's beta .

Beta Equation

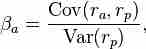

The beta of an investment is equal to the covariance between the rate of return of the investment, r(a), and that of the portfolio, r(p).

The beta coefficient, expressed as a covariance, is the risk of a new project in relation to the risk of the market as a whole. A company itself will be considered, for investment purposes, as a "portfolio of assets," and its beta coefficient will represent the weighted average of each "asset's" beta. Therefore, if a new project of differing risk is undertaken, the beta for that project will be weighted into the company's overall cost of capital. For example, if the project is twice as sensitive to fluctuations in the market as the company as a whole, then the project's beta should be twice that of the company during the valuation process. This will increase the risk premium on the project and its cost of equity and subsequently the weighted average cost of capital. This increase in cost of capital will devalue the company's stock, unless this increase was offset by a higher expected rate of return.