Chapter 15

Dividends

By Boundless

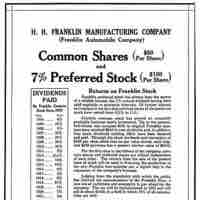

Dividends are a portion of company earnings regularly paid to shareholders, paid as some fixed amount per share price.

Dividends are attractive to many investors because they are seen as steady streams of income from low risk investments.

Under perfect market conditions, stockholders would ultimately be indifferent between returns from dividends or returns from capital gains.

Low dividend payouts can be interpreted in a number of ways, including: as a leading indicator of future growth or a sign of instability.

High dividend yields are attractive to investors who desire current income and stability since established firms often offer such stocks.

Accounting for dividends depends on their payment method (cash or stock).

The significance of investors' dividend preferences is a contested topic in finance that has serious implications for dividend policy.

Investors' preference for stock or cash depends on their inclinations toward factors such as liquidity, tax situation, and flexibility.

Dividend decisions are frequently seen by investors as revealing information about a firm's prospects; therefore firms are cautious with these decisions.

Change in a firm's dividend policy may cause loss of old clientele and gain of new clientele, based on their different dividend preferences.

Companies determine what kind of investors they want to attract and the investment opportunities they face before setting the target payout ratio.

The Residual Dividend Model first uses earnings to finance new projects, then distributes the remainder as dividends.

Dividends, which are distributed based on how many shares each person owns, can be paid using cash, stock, or other company property.

A stock split increases the number of shares outstanding without changing the market value of the firm.

Stock dividends are when a company gives each shareholder additional stock in lieu of a cash dividend.

Reverse splits are when a company reduces the number of shares outstanding by offering a number of new shares for each old one.

A share repurchase is when a company buys its own stock from public shareholders, thus reducing the number of shares outstanding.

Share repurchases are beneficial when the stock is undervalued, management needs to meet a financial metric, or there is a takeover threat.

Share repurchases often give an advantage to insiders and can be used to manipulate financial metrics.

Dividend reinvestment plans (DRIPs) automatically reinvest cash dividends in the stock.