Section 1

Introduction to Dividends

Book

Version 3

By Boundless

By Boundless

Boundless Finance

Finance

by Boundless

5 concepts

Defining Dividends

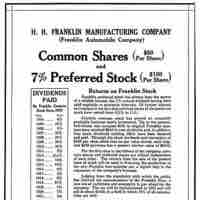

Dividends are a portion of company earnings regularly paid to shareholders, paid as some fixed amount per share price.

The Nature of Dividends

Dividends are attractive to many investors because they are seen as steady streams of income from low risk investments.

Dividend Irrelevance Theory

Under perfect market conditions, stockholders would ultimately be indifferent between returns from dividends or returns from capital gains.

Value of a Low Dividend

Low dividend payouts can be interpreted in a number of ways, including: as a leading indicator of future growth or a sign of instability.

Value of a High Dividend

High dividend yields are attractive to investors who desire current income and stability since established firms often offer such stocks.