In the United States, the Federal Reserve serves as the lender of last resort to those institutions that cannot obtain credit elsewhere and the collapse of which would have serious implications for the economy. It took over this role from the private sector "clearing houses" which operated during the Free Banking Era; whether public or private, the availability of liquidity was intended to prevent bank runs.

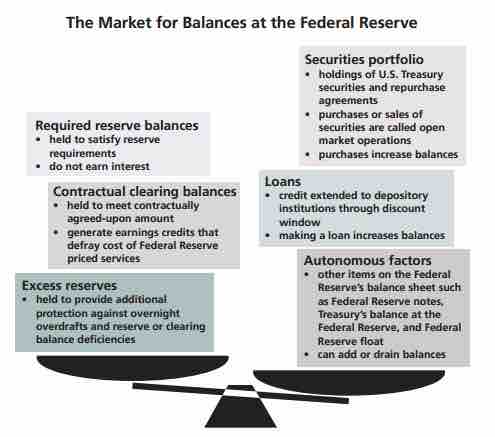

According to the Federal Reserve Bank of Minneapolis, "the Federal Reserve has the authority and financial resources to act as 'lender of last resort' by extending credit to depository institutions or to other entities in unusual circumstances involving a national or regional emergency, where failure to obtain credit would have a severe adverse impact on the economy. " Through its discount and credit operations, Reserve Banks provide liquidity to banks to meet short-term needs stemming from seasonal fluctuations in deposits or unexpected withdrawals. Longer term liquidity may also be provided in exceptional circumstances. The rate the Fed charges banks for these loans is the discount rate (officially the primary credit rate).

By making these loans, the Fed serves as a buffer against unexpected day-to-day fluctuations in reserve demand and supply. This contributes to the effective functioning of the banking system, alleviates pressure in the reserves market and reduces the extent of unexpected movements in the interest rates. For example, on September 16, 2008, the Federal Reserve Board authorized an $85 billion loan to stave off the bankruptcy of international insurance giant American International Group (AIG).

The Federal Reserve System's role as lender of last resort has been criticized because it shifts the risk and responsibility away from lenders and borrowers and places it on others in the form of inflation.