The Fed as a Check Clearer

The government of the United States of America is the federal government of the constitutional republic of 50 states that constitute the United States, as well as one capitol district, and several other territories. The federal government is composed of three distinct branches: legislative, executive, and judicial, with powers vested by the U.S. Constitution in the Congress, the President, and the federal courts, including the Supreme Court, respectively; the powers and duties of these branches are further defined by acts of Congress, including the creation of executive departments and courts inferior to the Supreme Court.

Check clearing is defined as "the movement of a check from the depository institution at which it was deposited back to the institution on which it was written, the movement of funds in the opposite direction, and the corresponding credit and debit to the accounts involved. Check clearing also encompasses the return of a check (for insufficient funds, for example) from the bank on which it was written to the bank at which it was deposited, and the corresponding movement of funds. "

Because some banks refused to clear checks from certain others during times of economic uncertainty, a check-clearing system was created in the Federal Reserve system. By creating the Fed, Congress intended to eliminate the severe financial crises that had periodically swept the nation, especially the sort of financial panic that occurred in 1907. During that episode, payments were disrupted throughout the country because many banks and clearinghouses refused to clear checks drawn on certain other banks, a practice that contributed to the failure of otherwise solvent banks. To address these problems, Congress gave the Federal Reserve System the authority to establish a nationwide check-clearing system. The system, then, was to provide not only an elastic currency—that is, a currency that would expand or shrink in amount as economic conditions warranted—but also an efficient and equitable check-collection system.

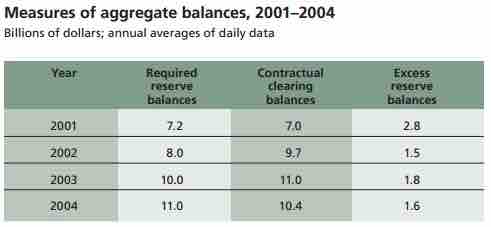

measures of aggregate balances, 2001-2004

Billions of dollars