The fundamental accounting equation, which is also known as the balance sheet equation, looks like this:

On the right side of the equation are claims of ownership on those assets: liabilities are the claims of creditors (those "outside" the business); and equity, or owners' equity, is the claim of the owners of the business (those "inside" the business). The fundamental accounting equation is kept in balance after every business transaction because everything falls under these three elements in a business transaction.

For example, when a company intends to purchase new equipment, its owner or board of directors has to choose how to raise funds for the purchase. Looking at the fundamental accounting equation, one can see how the equation stays is balance. If the funds are borrowed to purchase the asset, assets and liabilities both increase. If the company issues stock to obtain the funds for the purchase, then assets and equity both increase.

Additionally, changes is the accounting equation may occur on the same side of the equation. For example, if the company uses cash to purchase inventory, cash is decreased (credited) and inventory is increased (debited); thus, assets as a whole remain unchanged and the equation remains in balance. Likewise, as the company receives payment from its customers, accounts receivable is credited and cash is debited.

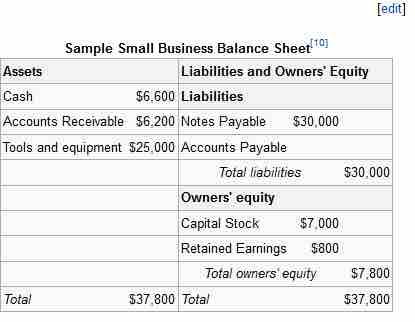

Sample Balance Sheet

A balance sheet shows how the accounting equation is applied.