Double-Entry Bookkeeping

A double-entry bookkeeping system is a set of rules for recording financial information in a financial accounting system in which every transaction or event changes at least two different nominal ledger accounts.

In the double-entry accounting system, each accounting entry records related pairs of financial transactions for asset, liability, income, expense, or capital accounts. Recording of a debit amount to one account and an equal credit amount to another account results in total debits being equal to total credits for all accounts in the general ledger. If the accounting entries are recorded without error, the aggregate balance of all accounts having positive balances will be equal to the aggregate balance of all accounts having negative balances. Accounting entries that debit and credit related accounts typically include the same date and identifying code in both accounts, so that in case of error, each debit and credit can be traced back to a journal and transaction source document, thus preserving an audit trail.

The "Golden Rules of Accounting"

The rules for formulating accounting entries are known as "Golden Rules of Accounting". The accounting entries are recorded in the "Books of Accounts". Regardless of which accounts and how many are impacted by a given transaction, the fundamental accounting equation A = L + OE (assets equals liabilities plus owner's equity) will hold.

There are two different approaches to the double entry system of bookkeeping. They are the Traditional Approach and the Accounting Equation Approach. Irrespective of the approach used, the effect on the books of accounts remain the same, with two aspects (debit and credit) in each of the transactions.

Traditional Approach (British)

Following this approach, accounts are classified as real, personal, or nominal accounts. Real accounts are assets. Personal accounts are liabilities and owners' equity and represent people and entities that have invested in the business. Nominal accounts are revenue, expenses, gains, and losses.

Transactions are entered in the books of accounts by applying the following golden rules of accounting:

- Personal account: Debit the receiver and credit the giver

- Real account: Debit what comes in and credit what goes out

- Nominal account: Debit all expenses & losses and credit all incomes & gains

Accounting Equation Approach (American)

Under this approach, transactions are recorded based on the accounting equation, i.e., Assets = Liabilities + Capital. The accounting equation is a statement of equality between the debits and the credits. The rules of debit and credit depend on the nature of an account. For the purpose of the accounting equation approach, all the accounts are classified into one of the following five types:

- Assets

- Liabilities

- Income/revenues

- Expenses

- Capital gains/losses

If there is an increase or decrease in one account, there will be an equal decrease or increase in another account. There may be equal increases to both accounts, depending on what kind of accounts they are. There may also be equal decreases to both accounts. Accordingly, the following rules of debit and credit in respect to the various categories of accounts can be obtained.

The rules may be summarized as below:

- Assets accounts: Debit increases in assets and credit decreases in assets

- Capital account: Credit increases in capital and debit decreases in capital

- Liabilities accounts: Credit increases in liabilities and debit decreases in liabilities

- Revenues or Incomes accounts: Credit increases in incomes and gains and debit decreases in incomes and gains

- Expenses or Losses accounts: Debit increases in expenses and losses and credit decreases in expenses and losses

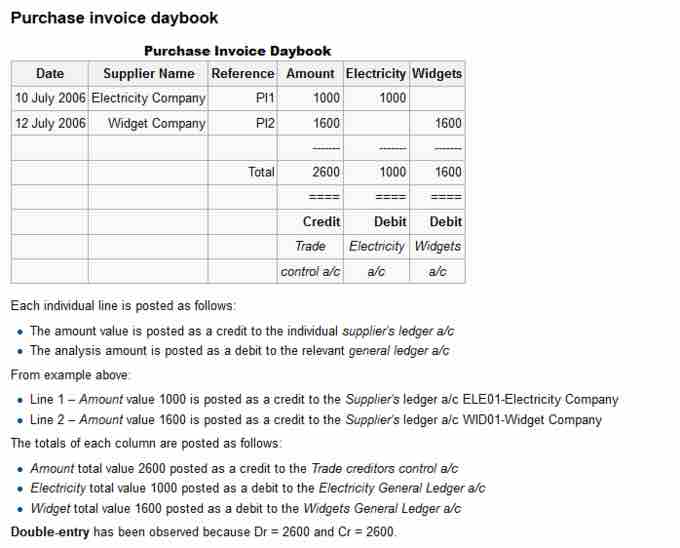

Example of Double entry bookkeping

Purchase Invoice Daybook