This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

This article has been viewed 100,007 times.

Having health insurance is not a guarantee that everything ordered by your doctor will be covered. If your insurance provider denies payment for a medical procedure, you will need to write a letter to appeal the decision. The Affordable Care Act increased patients' rights regarding appeals. Insurance companies are now required to explain the exact reasons they denied your claim. They must also allow you six months to appeal. If the amount of money involved is significant, you should make the effort to appeal your claim.

Steps

Reviewing the Denial of Your Claim

-

1Rule out simple mistakes first. Sometimes a claim is denied due to a simple clerical error. These mistakes are usually the easiest to correct. Read through all the documentation from your insurance company, to make sure there are no obvious errors. If you find that a mistake was made by someone at your doctor's office, contact the office staff and ask them to submit corrected forms to your insurance company. If the mistake appears to have been made by someone at your insurance company, call them, point out the error, and ask them to send you updated documents with the correct information.[1]

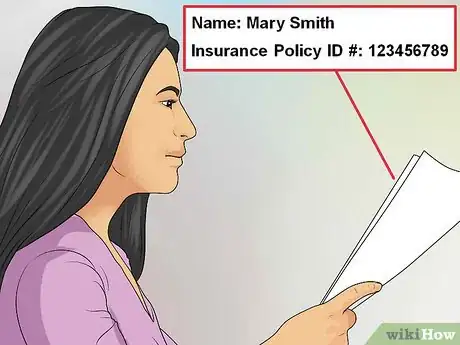

- Check that your name is spelled correctly, in case the insurance company has confused your file with someone else's. Also check your insurance policy ID number and the date that the procedure was performed, to be sure they were entered correctly.

- Check the procedure code to make sure it is correct. If you aren't sure, you may need to verify this with your doctor, your insurance provider, or both.

- Check your doctor's name and information against your policy to make sure that your insurance company has approved your doctor for coverage. Make sure everything is spelled correctly.

- Read through the description of the services rendered, and make sure it is an accurate representation of the procedure that was provided.

-

2Ask your doctor to rephrase his or her statement. If your insurance company denied a claim for a procedure that your health care provider deemed necessary, there may be a discrepancy between the wording of your doctor's statement and the wording of your insurance policy's guidelines. Take a copy of your insurance company's guidelines to your doctor's office. The doctor may be able to rephrase his or her statement so that it more precisely aligns with your insurance company's guidelines.[2]

- Print out the part of your insurance company's “clinical policy guidelines” that pertains to your case. Google the name of your insurance company and the words “medical policies” or “clinical policies” to find the correct documentation.

- Often, the insurance company's guidelines are posted on their web site for the convenience of practitioners, but are also accessible to members.

- Even if you don't understand the technical jargon used by your insurance company, your doctor will. Print out the entire section pertaining to your treatment, and ask if he or she will take a look at it.

Advertisement -

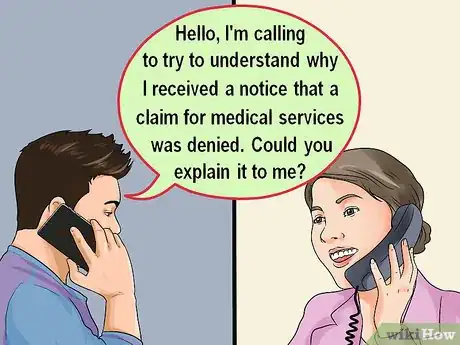

3Ask your insurance company why your claim was denied. Call your insurance company and ask them to explain why your medical claim was denied. Don't let the agent intimidate you, or try to confuse you – don't end the call until you understand their reasoning completely.[3]

- Be as patient and polite as possible when speaking with your insurance agent. It most likely wasn't that person's fault that your claim was denied, and they may be more willing to help you during the process if you are on friendly terms. For example, you can begin your call by saying, "Hello, I'm calling to try to understand why I received a notice that a claim for medical services was denied. Could you explain it to me?" (The agent will then undoubtedly need some specific information about your claim, which you should be able to provide.)

- If you get upset during the call, acknowledge that you are stressed about your claim. Apologize for losing your cool, and tell the agent that you know the situation is not his or her fault. If this happens, just pause, take a deep breath, and then go on: "I'm sorry, but I hope you can understand how important this is for me to understand. Could you please explain that again?"

-

4Request documentation. Call your insurance company to request copies of any relevant documentation that is missing from your files. If any corrections or changes were made to your file as a result of a phone conversation, ask your insurance company to send copies of the new, amended documents.[4]

- You will need the official denial letter.

- You will need a copy detailing your policy coverage. Sometimes called the “Evidence of Coverage,” this document should explain the guidelines your insurance company uses to determine whether a medical procedure is medically necessary.

- You can also check online to see if your insurance company has posted their Evidence of Coverage.

-

5Keep notes of all calls you make. When speaking to your insurance company, keep detailed notes for future use. Write a short summary of the conversation, and keep your notes in the same file as your documentation.[5]

- Make note of the name of the person you spoke with, his or her job title, and the date and time of the call.

- Ask for the “call reference number” at the end of the conversation. This may help eliminate the need to repeat your case every time you call.

- If an appeal has been submitted, ask for the “document image number.” This may help the telephone agent pull up your information more quickly the next time you call.

Preparing Your Appeal

-

1Ask the insurance company agent to outline the appeals process. Call your insurance company and ask what steps you need to take to appeal a negative decision. You don't need to make this confrontational. Appealing a claim is just a part of the business. But you will need help in understanding the process.[6]

- If you have decided that you will be filing an appeal, simply ask, "Will you please explain to me what I need to do to appeal this decision?"

- Ask your insurance company if they require any specific forms. If so, have them sent to you immediately, or find out if they are available online.

- The explanation of benefits that you received when you opened your policy should contain details of your insurance company's appeals process.

- Find out what your deadline is for filing an appeal. The agent should be able to give you a specific deadline. Be sure that you make a note of it and mark it on your calendar.

-

2Gather all the pertinent information you will need. Before you begin writing your letter, collect all the pertinent information in one file. You may want to refer to specific documents when writing your letter. In particular, get together any of the following:

- notes from your visit to the doctor

- a copy of your insurance policy contract, with relevant language highlighted

- a copy of the letter denying your claim

- a copy of any bills or notices you may have received regarding the claim

- any notes you have from prior telephone conversations regarding the claim.

-

3Collect supporting information from your doctor. Call your doctor's office as soon as you become aware of the problem. Ask for written documentation of your case, specifically outlining the procedure and why it was medically necessary.

- Your doctor may also make copies of notes from your charts that you could include.

- Ask your doctor's office to supply you with copies of any medical records that relate to your case. The more proof you have to support your claim, the better.

-

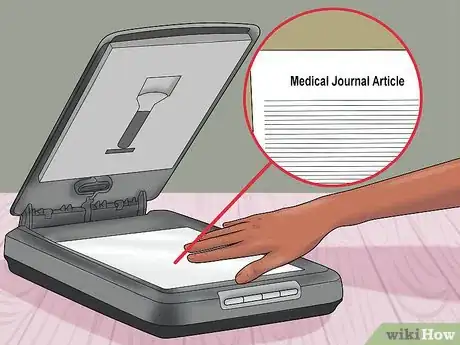

4Make copies of relevant medical journal articles. If you find any information about your procedure that supports its efficacy or necessity, make copies of the article. Be sure your information is collected from authoritative, peer-reviewed medical sources.

Writing a Medical Claim Appeal Letter

-

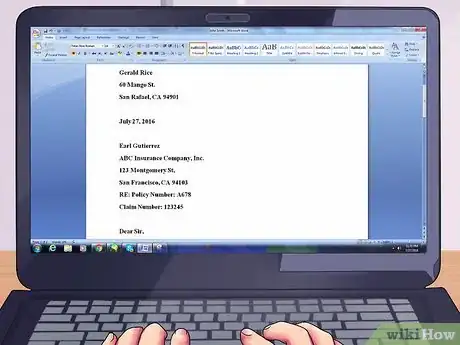

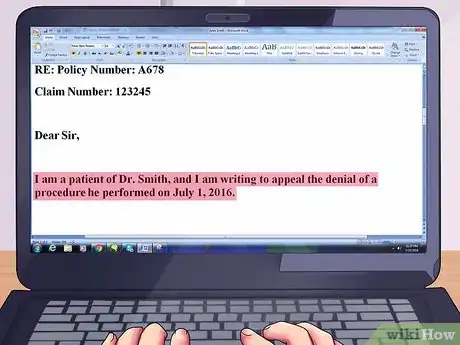

1Supply your identifying details. Start with your name, address, policy number, claim number, and any other reference numbers you may have collected (through letters or over the phone) that identify your case.

- Include your insurance policy number, admission and discharge dates, and the exact amount of charges you are claiming.

- Rather than including this detailed information in sentence form in your letter, it is probably most helpful to provide it in a reference line at the top of your letter. For example, your own name and address will appear at the top of the page, and then the address of the appeals office, as in a standard business letter. Then, a line or two below the address, write "Re: Claim No. 12345, Policy No. A678." Then go on with your letter, "Dear Sir or Madam."

-

2Address the letter to the director of claims, unless otherwise directed. Note in the first paragraph of the letter your medical provider's name and the date the services in question were rendered.

- If your insurance company appeals process lists a specific person to whom appeals should be directed, address your letter to that person.

- In the opening paragraph, explain your situation: "I am a patient of Dr. Smith, and I am writing to appeal the denial of a procedure he performed on July 1, 2016."

-

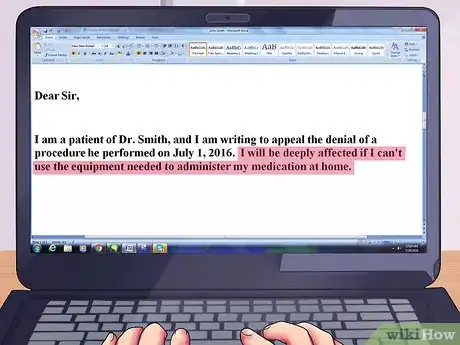

3Describe the situation in your own words. Explain your medical condition and the way that it affects your life. Tell your insurance company why you need the prescribed procedure, equipment, or service.

- Be polite when choosing your words, and try not to allow your frustration to be too apparent in your letter. It is always more helpful, in a letter like this, to limit yourself to factual information, rather than emotional.

-

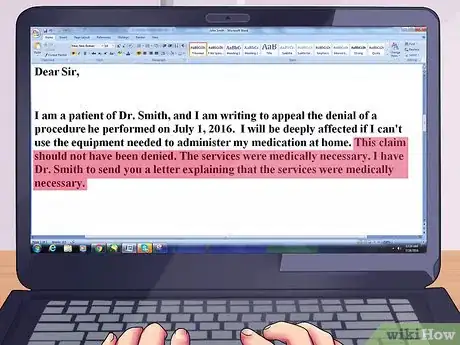

4Explain why you believe the procedure should be covered. Outline your reasoning as to why the medical procedure should be covered by your insurance policy. Use your own words and try to avoid medical jargon.

- If you are appealing only part(s) of a claim, identify which part(s) you are disputing.

-

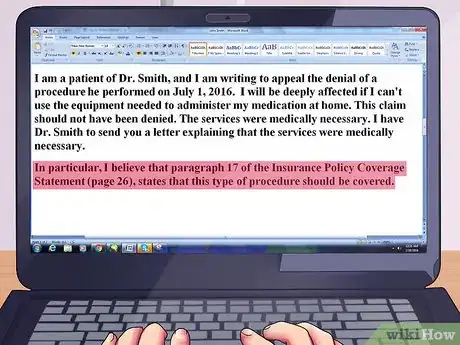

5Present your evidence. Describe the additional documents you are including, and why you believe they support your case. If you believe the service in question will help prevent future expenses, such as hospital readmission or problematic side effects, be sure to explain why.

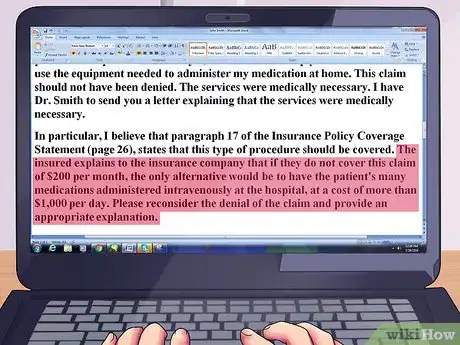

- Make specific references to relevant attached documents as you write your letter. Highlight important passages in your supporting documents. For example, you might say, "In particular, I believe that Paragraph 17 of the Insurance Policy Coverage Statement (page 26), states that this type of procedure should be covered."

-

6Argue that allowing your claim will save the company money. A very persuasive argument is to demonstrate that paying this claim will save the insurance company money later on. If your insurance company denies coverage for a certain procedure, you can try to persuade them that approving this claim will cost them less money in the long run.

- Example of a denied claim: An insurance company denies a claim to pay for equipment needed to administer medication at home via a J-tube (a jejunostomy feeding tube vents a patient's stomach for air or drainage, and/or to supply an alternative method for feeding the patient or administering medication).

- Example of the appeals case: The insured explains to the insurance company that if they do not cover this claim of $200 per month, the only alternative would be to have the patient's many medications administered intravenously at the hospital, at a cost of more than $1,000 per day.

-

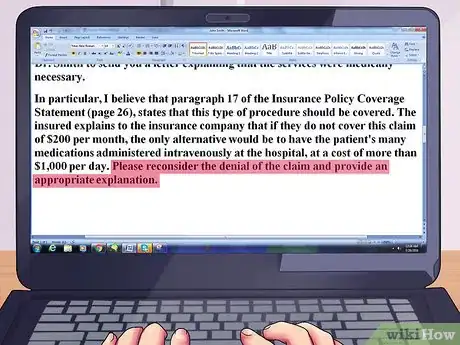

7Request a case review. Specifically ask your insurance provider to review your claim again. Indicate whether the information in the first claim was correct or if some information had been amended.

-

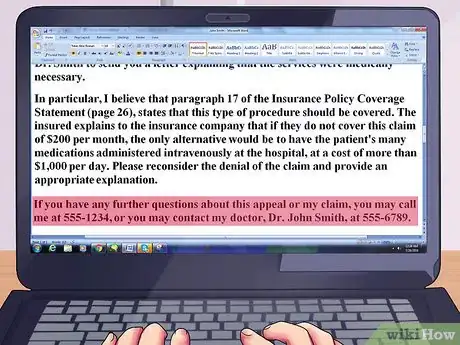

8Conclude your letter in a courteous manner. Thank the recipient for his or her time and prompt attention. Include your phone number, email address, or any other convenient way you can be reached.

- Include contact information for both yourself and your doctor.

- A typical closing paragraph might say, "If you have any further questions about this appeal or my claim, you may call me at 555-1234, or you may contact my doctor, Dr. John Smith, at 555-6789."

Submitting Your Claim Appeal

-

1Follow up within the mandatory timeline. Preparing your appeal letter may take some time, but you must submit it before the deadline expires. Never expect the insurance company to follow up with you – be proactive. If you miss the deadline, you risk losing the opportunity to have your case reviewed.[7]

-

2Attach your supporting documents. Include in the envelope any documentation you collected regarding your case. Staple the documents to your letter, so they have less chance of being misplaced when your letter is opened.

- Attach a letter from your doctor, especially if you were able to procure a rephrased statement that more closely aligns with the stated policies of your insurance company.

- Include any medical records you obtained, and any notes your doctor may have made about your case.

- Include copies of any relevant medical journal articles you find that support the procedure in question as being medically relevant.

-

3Ask your doctor to review your letter. If you believe that your doctor would be willing to review your case, ask him or her to read your letter before posting it. Your doctor may notice a detail you have missed or an aspect of the case you have misunderstood.

-

4Send your letter via certified mail. Request a return receipt, so you will have proof that your insurance company received your letter by the deadline. If your letter is lost in the mail or misplaced by your insurance company, you will be able to prove exactly when you mailed the letter.

- Keep at least one copy of the letter, the postal delivery receipt and tracking number, and copies of any correspondence pertaining to your claim.

References

- ↑ https://www.nerdwallet.com/blog/health/managing-health-insurance/tips-appealing-denied-health-insurance-claim/

- ↑ http://www.huffingtonpost.com/linda-bergthold/health-insurance-claim-de_b_881538.html

- ↑ http://guides.wsj.com/health/health-costs/how-to-appeal-a-health-insurance-denial/

- ↑ http://guides.wsj.com/health/health-costs/how-to-appeal-a-health-insurance-denial/

- ↑ https://www.nerdwallet.com/blog/health/managing-health-insurance/tips-appealing-denied-health-insurance-claim/

- ↑ http://guides.wsj.com/health/health-costs/how-to-appeal-a-health-insurance-denial/

- ↑ https://www.nerdwallet.com/blog/health/managing-health-insurance/tips-appealing-denied-health-insurance-claim/

About This Article

If your health insurance provider has denied payment for a medical procedure, you can write a medical claim appeal letter to ask them to reconsider it. First, call your insurance company and ask them why your coverage was denied. Once you’ve gotten your answer, ask them how you appeal the decision and where you should address your letter. Then, gather any evidence you have to support your case, like doctor’s notes to show it was necessary, bills, and medical records. You can also search for medical journal articles online that show your procedure was necessary. When you write your letter, explain why you think the procedure should be covered and reference any evidence you have. Include copies of the evidence with the letter and send it by certified mail so you can be sure they’ve received your appeal request. For more tips from our Legal co-author, including how to argue that your claim will save your insurance provider money, read on.