This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

This article has been viewed 219,622 times.

Form 1099-K is used to report income received from electronic payments such as credit cards, debit cards, PayPal, and other third party payers. In most cases, the payment settlement entity (PSE) will send you a 1099-K by January 31. This income needs to be included in your total business earnings. Depending on how you keep your business records, the amount may already be reflected in your books, so make sure you don't count the same income twice.

Steps

Verifying the 1099-K Form's Accuracy

-

1Check if a third party company processed business payments for you. A payment settlement entity (PSE) is any third party company that handles payment transactions. For example, PayPal and Google Checkout are PSEs. If you're a business owner, you may have payments processed through one or more of these entities. If you earned income through them, PSEs will send you a 1099-K form with your total amount earned through them during the prior year.[1]

- The company that processed your payments will send you a 1099-K form that shows how much you earned from credit cards, debit cards, and money transfers.

-

2Assess the number of transactions and the gross payments received. If you conducted 200 or more transactions with one or more PSEs that garnered a total income of $20,000 or more, you should receive a 1099-K form in the mail with these totals reflected on the form. If you conducted fewer than 200 transactions or the total came to less than $20,000, you do not need a 1099-K form.[2]

- Sometimes companies send out 1099-K forms even when the recipient may not be required to use them.[3]

- Not everyone who accepts credit card or third-party payments has over 200 transactions during a given tax period. For example, if you're self-employed and only received 30 credit card payments last year, you won't need a 1099-K. If your business does not accept credit cards or other forms of electronic payment, you should not receive this form.

- The gross amount of a reportable payment does not include any adjustments for credits, cash equivalents, discount amounts, fees, or refunded amounts.

Advertisement -

3Check the totals against your records. Make sure that your business records accurately reflect the income reflected on the form you receive. Check your merchant statements and payment card receipt records to ensure accuracy and have backup in case you are audited. If you feel there is inaccurate information on your 1099-K, call the PSE that sent it to have a correction made. You should also contact the PSE if the following errors occur on your form:[4]

- The form is a duplicate

- The Taxpayer Identification Number is incorrect

- The number of payment transactions is incorrect

- The Merchant Category Code doesn't describe your business correctly

-

4Make corrections to your form or reporting information if the amount is wrong. It's possible that your 1099-K may reflect more than you earned under certain circumstances. For example, you may have shared a credit card terminal with another business owner, resulting in a 1099-K that reflects their income as well as yours. If you believe the income reflected on the form is wrong, you can request a corrected form or update your business information, depending on what caused the error. Here are the potential issues that may occur:[5]

- The 1099-K is in your name instead of your business name

- You shared your credit card terminal with another person or business

- You bought or sold your business during the year

- You changed your business structure, such as going from sole-proprietorship to partnership

- You gave debit card customers cash back

- You received income from multiple income streams

Reporting 1099-K Income

-

1Report it on Form 1040 if you are self-employed. If you're self-employed or an independent contractor, you'll report your 1099-K income on Schedule C of form 1040. To report your 1099-K income on this form, simply enter your gross 1099-K income on line 1 of Schedule C.

- If you received more than one 1099 form, you need to add them together and report the total amount of money you made. All of your business earnings will be reported together, including money your received through cash or check.

- You’re responsible for keeping track of any business expenses you had and reporting them as deductions on your Schedule C.

-

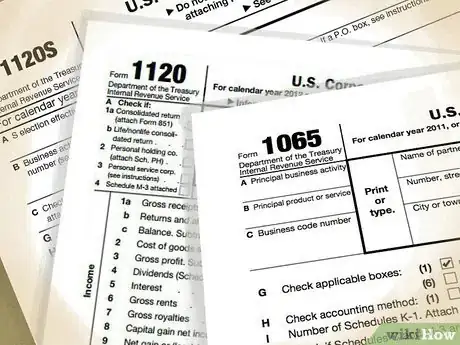

2Report it on Forms 1065, 1120 or 1120S if applicable. If you have a partnership, corporation or an S corporation, you'll report your 1099-K income on line 1a of your form. Find your gross 1099-K income and list it on the correct line.

- If you received more than one 1099 form, make sure the total you list on line 1a reflects all of them. The amount you report on your taxes should always meet or exceed the total amount of your 1099s because you need to report all of your income, including earnings received by cash or check.

Expert Q&A

-

QuestionDo I have to claim a 1099?

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Financial Advisor & Certified Public Accountant If you received a 1099, then the IRS also received a copy of it. If you choose not to report your 1099 earnings, then the IRS will send you a CP2000 notice, which is referred to as a "matching notice." This notice lets you know that you had unreported income, and it assesses the taxes you were supposed to pay, as well as any penalties or interest for not paying them on time, if applicable. It's better to report the income on your tax return because that way you can also claim deductions that might limit your tax burden. Plus, you avoid getting a notice.

If you received a 1099, then the IRS also received a copy of it. If you choose not to report your 1099 earnings, then the IRS will send you a CP2000 notice, which is referred to as a "matching notice." This notice lets you know that you had unreported income, and it assesses the taxes you were supposed to pay, as well as any penalties or interest for not paying them on time, if applicable. It's better to report the income on your tax return because that way you can also claim deductions that might limit your tax burden. Plus, you avoid getting a notice. -

QuestionCan I file income from a 1099 K on my next year's return without being penalized?

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Financial Advisor & Certified Public Accountant The income reported on a 1099-K should be reported in the year you earned it. Otherwise, the IRS will send you a matching notice, called a CP2000 notice. Keep in mind that the IRS receives a copy your 1099-K, so they know if you didn't report it. You may be charged additional taxes, penalties, and interest if you don't report all of your earnings for that year.

The income reported on a 1099-K should be reported in the year you earned it. Otherwise, the IRS will send you a matching notice, called a CP2000 notice. Keep in mind that the IRS receives a copy your 1099-K, so they know if you didn't report it. You may be charged additional taxes, penalties, and interest if you don't report all of your earnings for that year.

Warnings

- Keep in mind, 1099-K is used only to report to the IRS amounts of your gross receipts charged on the credit card. You still have to report the rest of your income that was paid by checks, cash, etc.⧼thumbs_response⧽

References

- ↑ http://www.irs.gov/Businesses/Understanding-Your-1099-K

- ↑ http://www.irs.gov/pub/irs-pdf/f1099k.pdf

- ↑ http://www.irs.gov/Businesses/Understanding-Your-1099-K

- ↑ http://www.forbes.com/sites/kellyphillipserb/2014/08/29/credit-cards-the-irs-form-1099-k-and-the-19399-reporting-hole/

- ↑ https://www.irs.gov/businesses/understanding-your-1099-k