This article was co-authored by Jill Newman, CPA. Jill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 90% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 408,232 times.

A statement of cash flows is one of the four major financial statements prepared by corporations at the end of each accounting period (the others being a balance sheet, income statement, and statement of retained earnings). The goal of the cash flow statement is to provide an accurate picture of the cash inflows, outflows, and net changes of cash during the accounting period. The statement is prepared by calculating net changes to cash from operating, investing, and financing activities. The total increase or decrease in cash for the current year is added to the ending cash from the prior year to calculate the ending cash and cash equivalents for the current year. Keep in mind that the ending cash amount on the statement of cash flows should be equal to the ending cash amount on the balance sheet. If the amounts are not equal, then there has been an error.

Steps

Calculating Beginning Cash and Cash Equivalents

-

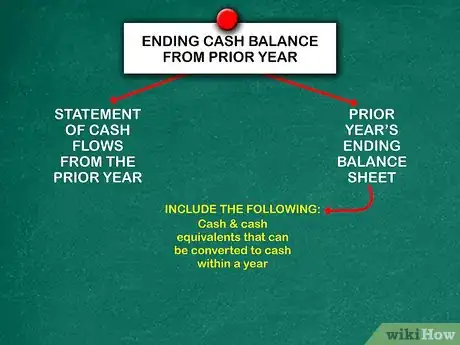

1Determine the ending cash balance from the prior year. If the company prepared a statement of cash flows for the prior year, you can find this information there. If not, you will have to find information from the prior year's ending balance sheet and calculate the ending cash balance. Include cash and cash equivalents that can be converted into cash within one year. Cash equivalents include money market funds, certificates of deposit and savings accounts.[1]

-

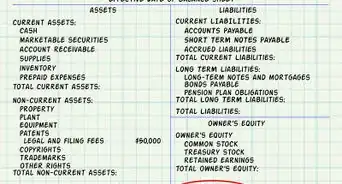

2Add up the value of all of the cash and cash equivalents. On the balance sheet, find the value of the cash and cash equivalents. Suppose, for example, at the end of the prior year, the company had $800,000 in cash. In addition, it had money market funds worth $2,500,000 and CDs worth $1,500,000. Finally, there were savings accounts worth $1,200,000.

- Add all of these amounts together to determine the ending cash balance for the prior year.

- $800,000 (cash) + $2,500,000 (money market funds) + $1,500,000 (CDs) + $1,200,000 (savings) = $6,000,000 (prior year ending balance).

Advertisement -

3Establish the beginning cash balance for the current year. The ending balance from the prior year becomes the beginning balance for the current year. Using the above example, the ending balance from the prior year was $6,000,000. Use this as the beginning balance for the current year.

- The beginning balance of cash and cash equivalents for the current year is $6,000,000.

Calculating Cash Generated from Operations

-

1Start with net income. Net income is total revenues less operating expenses, depreciation, amortization and taxes. It is the company’s profit for the year. It includes all of the money that is left over after expenses have been paid. It is found on the company’s income statement.[2]

- The company in the above example reported a net income of $8,000,000.

-

2Adjust for depreciation and amortization. Depreciation and amortization are non-cash expenses that record the decrease in value of assets over time. They are calculated based on the original value of the asset and its useful life. But, since these expenses do not require an expenditure or receipt of cash, the amounts must be added back to the cash balances.[3]

- The company in the above example reported $4,000,000 in depreciation and amortization expenses. As a consequence, $4,000,000 would be added back to the cash balance.

-

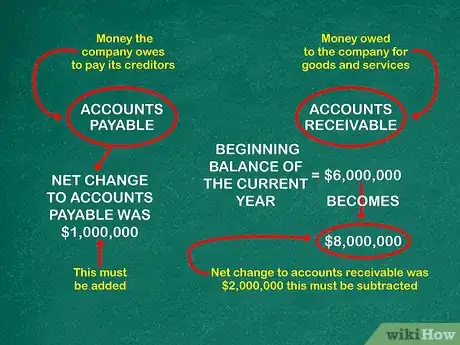

3Make adjustments for accounts payable and accounts receivable. Accounts payable is money the company owes to pay its creditors. Accounts receivable is money owed to the company for goods and services. For the income statement, accruals for accounts payable and accounts receivable are entered for the time period in which they occurred, whether or not cash has actually been paid or received. However, these accruals are non-cash transactions, so they must be adjusted for the statement of cash flows.[4]

- Make sure to check the balance sheet for accrued liability accounts, such as Accrued Taxes or Accrued Payroll. These are expenses that will occur in the future, but that are not cash expenses right now. However, you will still need to adjust for these on the statement of cash flows. On the other hand, if you have any Prepaid Assets on the balance sheet, then these are expenses that have already been paid but that have not been incurred. You do not need to adjust these.

- The Accounts receivable balance at the end of the prior year is the beginning balance of the current year. For example, imagine that the beginning balance was $6 million. At the end of the period, the accounts receivable balance is $8 million, an increase of $2 million during the year. Accounts receivable is income that has been earned, but not transferred into cash.

- Accordingly, an increase in AR during the period means that the company has used cash during the year to finance its sales and requires deducting the increase from the cash balance. A decrease in AR means that customers have paid down the amounts previously owed and requires adding the decrease back in the cash balance.

- For the company in the above example, net change to accounts receivable was $2,000,000. The money is still owed by customers, but it has not been paid. So, this must be subtracted.

- Net change to accounts payable was $1,000,000. This is money the company owes but has not yet paid. So this must be added.

-

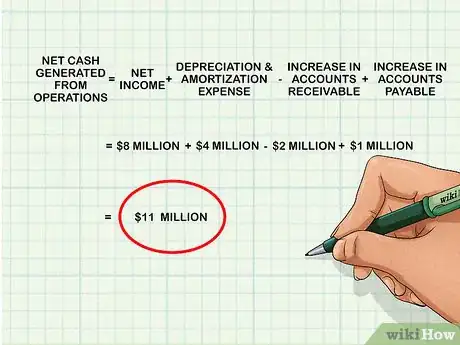

4Calculate net cash generated from operations. Start with net income. Add back in depreciation and amortization expense. Reverse accruals for accounts payable and accounts receivable.

- $8 million (net income) + $4 million (depreciation & Amortization expense) - $2 million (increase in Accounts Receivable) + $1 million (increase in Accounts Payable) = $11 million (net cash generated from operations).

- The net cash flow provided by operating activities is $11,000,000.

Calculating Cash Flows from Investing and Financing Activities

-

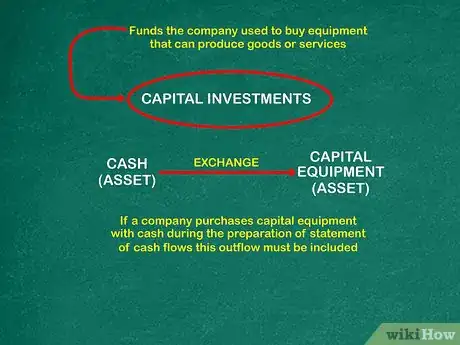

1Review investments in capital. Capital investments are all of the funds the company used to buy equipment that can produce goods or services.[5] When a company purchases equipment, it exchanges one asset (cash) for another asset (capital equipment). As a consequence, the purchase of the equipment is a use of cash. Similarly, if a company sold capital equipment, it would also be an exchange of one asset for another (receiving cash or an account receivable for the equipment). If a company purchases capital equipment with cash during the time period for which it is preparing the statement of cash flows, this outflow of cash must be included.[6]

-

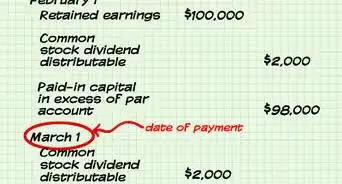

2Determine the impact of financing activities. Financing activities include issuing and redemption of long and short term debt, issuing and retirement of stock and payment of stock dividends. These activities can have positive and negative effects on cash flow. Issuing debt and stock increase the company’s cash. Redeeming debt and paying stock dividends decreases cash.

-

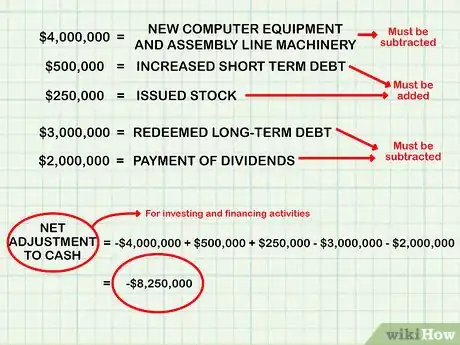

3Make adjustments for investments and financing. Deduct cash paid for purchasing capital equipment. Subtract cash paid to redeem debt or pay dividends. Add in cash raised by issuing stock or new debt. Imagine that the example company performed the following transactions:

- They purchased new computer equipment and assembly line machinery for a total of $4,000,000. This must be subtracted.

- They increased short term debt by $500,000 and issued $250,000 in stock. These must be added.

- Finally, they redeemed $3,000,000 in long-term debt and paid $2,000,000 in dividends. These must be subtracted.

- -$4 million (equipment purchases for cash) + $0.5 million (sale of debt for cash) + $0.25 million (sale of stock for cash) - $3 million (redemption of long-term debt) - $2 million (payment of dividends) = $8.25 million (reduction in cash during period due to investment and financing activities).

- The net adjustment to cash for investing and financing activities is -$8,250,000.

Calculating Ending Cash and Cash Equivalents

-

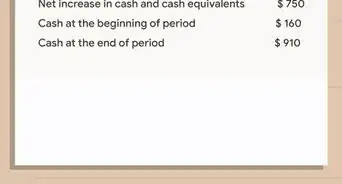

1Determine the net increase or decrease to cash. This means figuring out if there was a net increase or decrease to cash for the current year. Start with total cash flows from operating activities. Add adjustments to cash flows for investment and financing activities. The end result is the total net increase or decrease to cash for the year.

- In the above example, net cash flow from operating activities was $11,000,000.

- The net change to cash from investing and financing activities was -$8,250,000.

- The net increase or decrease to cash is .

-

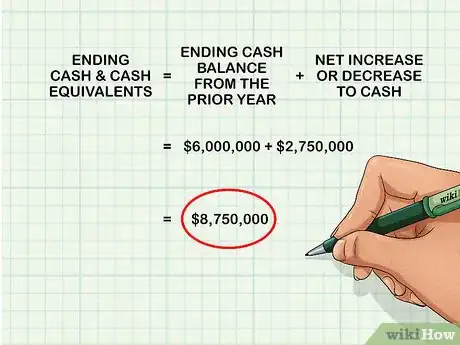

2Calculate ending cash and cash equivalents. Start with the ending cash balance from the prior year. Add the net increase or decrease to cash from the current year. The end result is the total ending cash and cash equivalents for this year.

- For the company in the above example, the ending cash balance from the prior year was $6,000,000.

- The net increase or decrease to cash for the current year was $2,750,000.

- The ending cash and cash equivalents for the current year is .

-

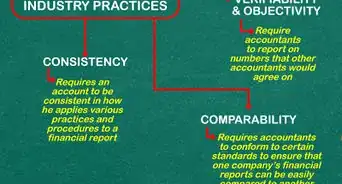

3Use the cash flow statement to evaluate the company’s financial health. The cash flow statement removes accounting methods such as accruals, depreciation and amortization. Therefore, it provides a more accurate statement of how cash is flowing in and out of the company. This allows investors to get a clear picture of the company’s earning power and operating success.[7]

- A net increase in cash usually means that the company is running its operations efficiently and responsibly managing its investing and financing activities.

- A net decrease in cash might indicate problems with the company’s operating, investing or financing activities. It would signal that the company needs to decrease expenses somewhere in order to improve its financial health.

- Keep in mind that cash flow analysis is only a small part of analyzing a company's financial health. A net decrease in cash might also be concurrent with a major investment in the company's future growth. Similarly, a net increase in cash might reflect that management is getting lazy about reinvesting in the company.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionHow do I adjust for WHT and VAT in cash flow statements?

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Financial Advisor WHT is withholding tax, so if this is a liability on the balance sheet, it would be employees' withholding taxes that have not yet been paid to local/state/federal agencies. The taxes are taken out of the employees gross pay, which was a cash expense, so nothing needs to be added back. If it is the employer's portion of payroll tax, it would be a payable account and this would be added back because it was recorded as an expense but not yet paid. VAT is value added tax and this would be treated like any other expense if it was accrued or booked as a payable.

WHT is withholding tax, so if this is a liability on the balance sheet, it would be employees' withholding taxes that have not yet been paid to local/state/federal agencies. The taxes are taken out of the employees gross pay, which was a cash expense, so nothing needs to be added back. If it is the employer's portion of payroll tax, it would be a payable account and this would be added back because it was recorded as an expense but not yet paid. VAT is value added tax and this would be treated like any other expense if it was accrued or booked as a payable. -

QuestionWhat can you do when ending cash is less than opening cash in the cash flow statement?

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Financial Advisor

References

- ↑ http://www.money-zine.com/investing/investing/building-a-cash-flow-statement/

- ↑ http://www.investopedia.com/terms/n/netincome.asp

- ↑ http://www.money-zine.com/investing/investing/building-a-cash-flow-statement/

- ↑ http://www.money-zine.com/investing/investing/building-a-cash-flow-statement/

- ↑ http://www.money-zine.com/definitions/investing-dictionary/capital/

- ↑ http://www.money-zine.com/investing/investing/building-a-cash-flow-statement/

- ↑ http://www.money-zine.com/investing/investing/understanding-cash-flow/

About This Article

To prepare a statement of cash flows, find out how much money the company had last year by checking the prior year’s ending balance sheet. Then, add the company’s net income, which is its revenue minus its expenses, taxes, and the depreciation of its assets. Make sure you include the amount the company owes other, and what others owe the company. Record those debts now, even though they haven’t been paid yet. Add those figures up to get your ending cash. Keep reading for tips from our Accounting reviewer on including investing expenses and income.