This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

There are 12 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 11,779 times.

If you hold stocks in a brokerage account, you don't normally have to pay any taxes on them, even if they increase in value. However, when you sell stocks, you may have to pay capital gains taxes if you sold them for more than what you bought them for. Additionally, if you get dividends from stock that you hold, those cash dividends may be taxed as regular income. Fortunately, as long as you manage your investments wisely, there are ways you can decrease or even eliminate the taxes you have to pay when you sell your stocks.[1]

Steps

Calculating Capital Gains

-

1Determine how long you held the stock before you sold it. Stocks are capital assets, so when you sell them for a profit you have to pay capital gains taxes. There are different rates for short-term capital gains and long-term capital gains. The long-term rate is lower than the short-term rate.[2]

- Generally, if you held the stocks for more than a year before you sold them, you would qualify for the long-term rate. Long-term rates are 0%, 15%, or 20% depending on your regular taxable income and your filing status (single, married filing jointly, married filing separately).

- If you only held the stocks for a few months before you sold them, you would have to pay the short-term rate. The short-term rate is the same as the rate for your usual tax bracket.

- Tax brackets are adjusted each year for inflation. Brackets for the coming tax year are typically announced by the IRS before the end of the previous calendar year.[3] You can find them on the IRS website, financial news services, or the websites of tax preparation services.

-

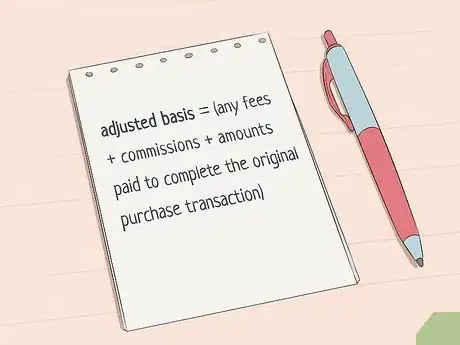

2Find your adjusted basis in the stock. The IRS uses the term "basis" to refer to the amount you originally paid for the stock. To find your adjusted basis, add to your basis any fees, commissions, or other amounts you paid to complete the original purchase transaction.[4]

- If you bought the stock at different times, you may have different fees and commissions to take into account. However, you'll report stock you bought at different times as separate assets on your taxes.

- If you no longer remember how much you paid for the stock or what the commissions and fees were on the trade, look up the record of the transaction with your broker.

Tip: If you inherited the stock or someone gave it to you as a gift, your basis is the fair market value in the stock at the time it came into your possession. A broker or financial advisor can help you figure that out.

Advertisement -

3Total your costs related to the sale to find your amount realized. When you sell stock, you'll likely pay fees and commissions. The IRS allows you to subtract these costs from the amount you made off the sale. The final amount is referred to as your "amount realized" on the transaction.[5]

- If you paid the same amounts in fees and commissions when you bought the stock as when you sold it, these costs will likely cancel each other out. However, it's still important to get the correct amounts to make sure you calculate your gains or losses correctly.

Tip: Save your documentation for the fees and commissions you paid both when you bought the stock and when you sold the stock. You may need them to prove your calculations if you get audited.

-

4Subtract your adjusted basis from the amount you realized from the sale. If your adjusted basis is smaller than your amount realized, you have a capital gain. On the other hand, if your adjusted basis is larger than your amount realized, you have a capital loss.[6]

- When you do your calculation, your result will be a negative number if you have a capital loss. You still have to report capital losses on your taxes, although you don't have to pay any taxes on this amount. You may be able to use it to offset other capital gains. For example, if you had $1,000 in long-term capital losses and $1,500 in long-term capital gains, the losses would offset $1,000 in long-term capital gains, so you would only have to pay taxes on the $500 net gain.

-

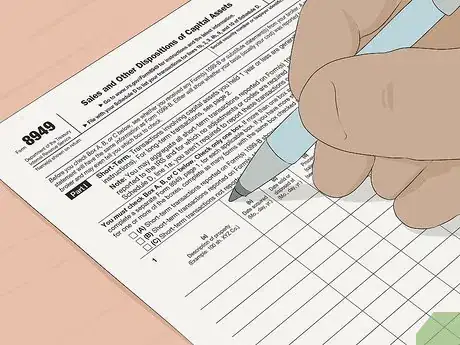

5Report your capital gains on Form 8949. On Form 8949, you'll write a description of the stock, the date you acquired it, the date you sold it, the amount you realized from the sale, and your adjusted basis in the stock. From there, you'll report your gain or loss from the transaction.[7]

- Stock that was bought at different times should be listed as separate assets, even if it was stock in the same company.

- If you're preparing your tax return by hand, download Form 8949 at https://www.irs.gov/forms-pubs/about-form-8949.

-

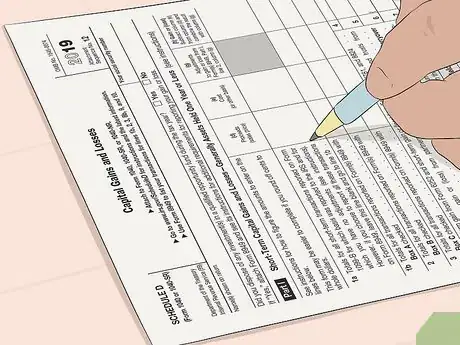

6Use Form 8949 to fill out Schedule D (Form 1040). Transfer the data from your Form to the Schedule according to the instructions. If you reported multiple transactions, you'll need to total short-term gains and long-term gains separately. They will be subject to different tax rates.[8]

- Once you've completed Schedule D, it will tell you what amounts to enter on your Form 1040. If you realized a total gain, you'll pay taxes on that amount. If your total amount is a loss, you may be able to use it to offset other tax liability.

- If you're preparing your tax return by hand, download Schedule D at https://www.irs.gov/forms-pubs/about-schedule-d-form-1040.

Including Income from Dividends

-

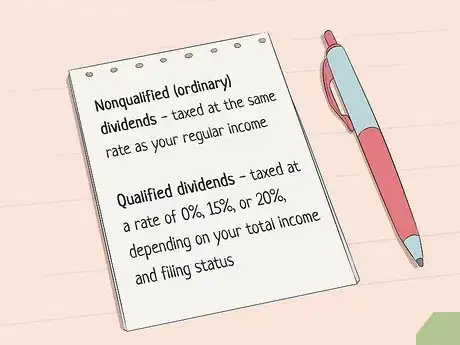

1Determine whether your dividends are qualified or nonqualified. Nonqualified dividends, also called "ordinary" dividends, are taxed at the same rate as your regular income. Qualified dividends are taxed at a rate of 0%, 15%, or 20%, depending on your total income and filing status (single, married filing jointly, or married filing separately).[9]

- Generally, dividends become qualified after you've held them for at least a year. The tax treatment is similar to the tax treatment for short-term and long-term capital gains.

Tip: If you're in a lower tax bracket, you may not have to pay any taxes on your dividends. However, you're still responsible for reporting them.

-

2Wait to receive a Form 1099-DIV. Most corporations that issue dividends use a Form 1099-DIV to report those dividends at the end of the year. You'll get this form in the mail, typically sometime in January or February. This is an informational form. You don't have to file it with your taxes, but you should keep it with your other tax records for the year.[10]

- Not all corporations use a Form 1099-DIV. Even if you don't get the form, you're still responsible for reporting any dividends you received on your taxes.

- All dividends you've received for the tax year will be listed on your statements from your broker. You can also access this information through your online account.

-

3Report any dividends you received on Form 1040. Line 3 of Form 1040 asks for dividend income. Qualified dividends go on line 3a, while ordinary dividends go on line 3b. If you had over $1,500 in ordinary dividends, you may need to fill out Schedule B.[11]

- If you have a Form 1099-DIV, ordinary dividends will be reported in box 1a and qualified dividends will be reported in box 1b.

Lowering Your Tax Burden

-

1Hold your shares long enough for your dividends to be qualified. You'll pay fewer taxes on qualified dividends than on ordinary dividends. Typically, you need to hold your shares for at least a year for them to reach qualified status.[12]

- Your dividend tax rate depends on your taxable income and filing status. If you're in a higher tax bracket, you'll still pay 20% taxes on qualified dividends. However, this may still be lower than the rate you pay on your ordinary income. As of 2019, filers with a taxable income of $434,551 or more ($488,851 if married filing jointly) pay the 20% rate on qualified dividends.

- If you're in a lower tax bracket, you may not have to pay any taxes at all on qualified dividends. If your taxable income is $39,375 or less ($78,750 if married filing jointly), qualified dividends are taxed at 0%.

-

2Sell underperforming stock to increase your capital losses. If you sold some stock and know you made some money, take a look at your portfolio and identify poorly performing stocks that you could possibly get rid of. If you sell them at a loss, you could use that loss to offset your gains.[13]

- Make sure your gains and losses are of the same character. You can't sell short-term assets and use the loss to offset long-term gains and vice versa.

-

3Keep your shares and dividends in a tax-advantaged retirement account. Dividends and capital gains on stock held in a 401K or Roth IRA are tax-free. You don't even have to report them on your taxes.[14]

- In addition to not having to pay taxes on gains or dividends, you may also get a tax credit for contributions you make to your retirement account during the year.

Tip: Taxes on gains and dividends in a traditional IRA are deferred, which means you will have to pay them when you start withdrawing from your account in retirement. However, you still don't have to pay them now.

-

4Hold your stocks for more than a year before selling them. If you hold your stocks for at least a year, they become long-term capital assets and will be charged at a tax rate of 0%, 15%, or 20%. The rate that applies to your gains depends on your total taxable income and filing status (single, married filing jointly, or married filing separately).[15]

- If you're in a lower tax bracket, you may not have to pay any taxes at all on long-term capital gains. The tax rate for long-term capital gains is 0% if your taxable income is $39,375 ($78,750 if married filing jointly), as of the 2018 tax year.[16]

- If you sell your stocks after owning them for less than a year, your gains will be taxed at the same rate as the rest of your income.

Warnings

- This article covers how to pay taxes on stocks in the US. If you live in another country, the rules may be different. Talk to a tax attorney, financial advisor, or other tax professional near you.⧼thumbs_response⧽

- Tax rates and forms may vary each year. The details in this article are accurate as of the 2018 tax year.⧼thumbs_response⧽

- If you sold stock at a significant gain but did not adjust your regular withholding from your salary, you may need to pay estimated quarterly taxes on the gain. Talk to an accountant or other tax professional.[18]⧼thumbs_response⧽

References

- ↑ https://www.nerdwallet.com/blog/taxes/taxes-on-stocks-how-they-work-pay-less/

- ↑ https://www.nerdwallet.com/blog/taxes/taxes-on-stocks-how-they-work-pay-less/

- ↑ https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2019

- ↑ https://www.irs.gov/publications/p551#en_US_201812_publink1000256905

- ↑ https://www.irs.gov/publications/p550#en_US_2018_publink100010427

- ↑ https://www.irs.gov/publications/p550#en_US_2018_publink100010427

- ↑ https://www.irs.gov/publications/p550#en_US_2018_publink1000267400

- ↑ https://www.irs.gov/publications/p550#en_US_2018_publink1000267400

- ↑ https://www.nerdwallet.com/blog/taxes/taxes-on-stocks-how-they-work-pay-less/

- ↑ https://www.irs.gov/publications/p550#en_US_2018_publink100010067

- ↑ https://www.irs.gov/faqs/interest-dividends-other-types-of-income/1099-div-dividend-income/1099-div-dividend-income

- ↑ https://www.nerdwallet.com/blog/taxes/dividend-tax-rate/

- ↑ https://www.nerdwallet.com/blog/taxes/selling-stocks-in-a-panic-could-jack-up-your-tax-bill/

- ↑ https://www.nerdwallet.com/blog/taxes/taxes-on-stocks-how-they-work-pay-less/

- ↑ https://www.nerdwallet.com/blog/taxes/selling-stocks-in-a-panic-could-jack-up-your-tax-bill/

- ↑ https://www.nerdwallet.com/blog/taxes/capital-gains-tax-rates/

- ↑ https://www.irs.gov/faqs/capital-gains-losses-and-sale-of-home/stocks-options-splits-traders/stocks-options-splits-traders-7

- ↑ https://www.marketwatch.com/story/do-you-owe-estimated-taxes-2015-02-18