This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 135,310 times.

Learn more...

Swiss private bank accounts offer the highest quality offshore banking services available. There are many reasons why a corporation, a firm, or even a private citizen might choose to open a Swiss private bank account. Swiss private banking is the most prestigious banking in the world. Private bankers build up strong relationships with their clients, helping them to ensure a more financially prosperous outcome for their money. If you qualify, opening a swiss private bank account is quite similar to opening a regular bank account and can be done in a few simple steps.

Steps

Deciding to Open a Swiss Bank Account

-

1Figure out if you qualify. For the most part, anyone over the age of 18 with enough money can open a Swiss bank account. However, you will have to prove that your money comes from a legitimate, legal source and that you are not exposed to significant political risk (a dictator or other politician from an embattled nation). In addition, citizens of some countries, like Russia and Iran, may be excluded from opening an account because of political sanctions.

- For many Swiss private banks, you will need an initial minimum deposit of at least $250,000, if not $1 million or more.

- To qualify, you will have to provide a valid passport as well.[1]

-

2Understand what swiss bank accounts are primarily used for. Swiss private banks generally do not offer standard checking or savings accounts to foreigners. Rather, the main purpose of these accounts is investment. This means that these accounts can not be used for regular withdrawals to pay for things like your mortgage, car payment, etc. Most people use these accounts to store large sums of money, usually as a method of protection against external forces, like taxation, risk in their home country, or currency fluctuations.[2]Advertisement

-

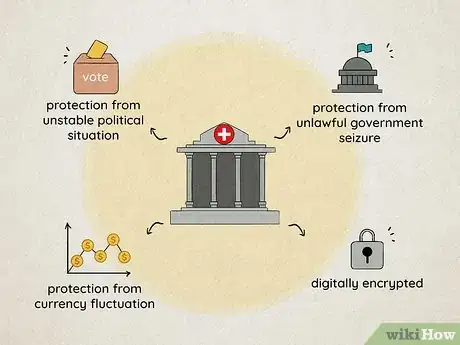

3Know how your money will be protected. Swiss private bank accounts are generally used to protect money from unstable political or economic situations in the home country of the depositor. Many of these accounts are held as Swiss Francs (the currency of Switzerland), which is a very stable currency. This protects depositors from fluctuations in the value of their home currency which could devalue their assets. Additionally, money in these accounts is protected from unlawful government seizure and digitally encrypted to prevent theft.

- Despite popular opinion to the contrary, money in these accounts is not safe from the taxation of your home country. By law, your account balances must be reported to your home country's tax authorities.[3]

-

4Consider your privacy needs. One of the major draws of Swiss bank accounts is that they are much more private than other banks. All of your account information is completely confidential, including any submitted documentation like business plans and the origin of your funds. In many cases, Swiss bankers can be jailed for revealing your personal information. However, the exception to this rule is that several nations, notably the European Union and the United States, have agreements in place that require Swiss bankers to share tax information for citizens of these nations that hold Swiss accounts.[4] Your information may also be disclosed for the purpose of:

- Determining assets in divorce or inheritance proceedings.

- Debt recovery in bankruptcy proceedings.

- Criminal court cases.

- Financial market regulatory investigations.

-

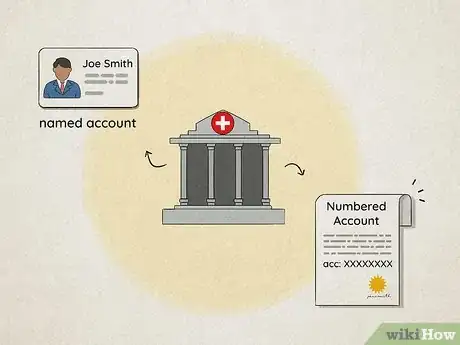

5Decide between a named or numbered account. A numbered account is one that is only identified by a banking number in all transaction. That is, your name is not tied to the account over the course of regular transactions. However, in order to open this type of account, you will still have to provide the bank with documents proving your identity. Some banks offer this type of account as a way of offering an increased level of privacy for their clients. Contact your bank to see if this is an option for you.

- The name associated with your numbered account will still be known by banking officials and kept on record at the bank.[5]

Opening an Account

-

1Choose a bank. Switzerland has a number of different types of banks, from large, international banks to smaller, regional banks that only serve a small geographical area. However, the private banks that cater specifically to wealthy and international clients are generally separate banking entities entirely. That is, they are rarely connected to banks offering regular banking services in Switzerland. Private banks can either be located through an online search for "private Swiss bank" or through a banking broker. A few of the more well-known of these banks are:

- Pictet Private Banking.

- SwissPartners.

- Vontobel Private Banking.

- UBS Private Banking.[6]

-

2Check deposit requirements. Swiss private bank accounts are intended for wealthy clients, and their initial required deposits reflect that. For many of these banks, depositors must have an initial deposit of up to 1 million Swiss Francs (about 1.05M USD). However, some of them allow deposits of lower amounts, like 250,000 Swiss Francs. Check with each bank to inquire about these limits.[7]

-

3Gather the required documents. To open a Swiss account, you will need documents proving your identity and the source of your funds. Obviously, you will also need your initial deposit, in the form of a wire transfer, check, or cash (if the bank will allow it). Specifically, you'll need to gather:

- A valid passport.

- Some document verifying your address.

- A way to prove the legitimacy of the source of your deposit (financial statements, inheritance documents, etc.)

- Identification for beneficiaries of the account.

- Other documents as requested by the bank.[8]

-

4Meet with a private banker. For many private banks, you will have to travel to Switzerland and meet with a private banker to set up your account. Some Swiss banks allows online account signups or mail-order ones, but the vast majority of the private banks require either an in-person meeting or working through an intermediary, like a financial services company or law firm.[9]

- Once you have made contact with the bank, a Swiss private banker will talk you through the procedure of opening an account.

Complying With the Law

-

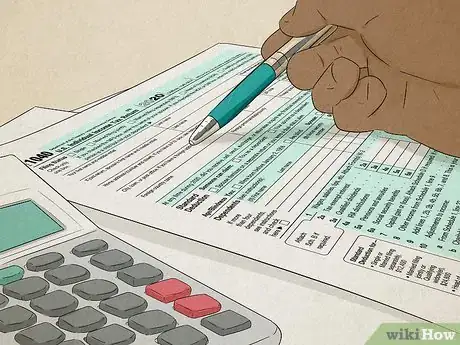

1Know that your assets will still be taxed in your home country. Swiss banks only want taxed assets. Switzerland will adopt the automatic exchange of information (AEOI) as of 2018. This means that information about the account will be automatically given to the tax authorities of your country of residence once a year (if your country of residence has signed an AEOI-agreement with Switzerland).

- A 2012 agreement requires Swiss banks to share information on accounts held by US citizens with US authorities. This information is shared with the consent of the account holder.

- However, if that account holder refuses to share the information, the US government can still obtain the information on their own.[10]

-

2Report your Swiss bank account balance when filing your taxes. You will have to report your Swiss bank account balances and any earnings or losses on those balances when filing your annual tax returns. To make sure you are filing them correctly, it is best to let a tax professional handle them or at least consult with one before filing.[11]

-

3Talk to a tax lawyer if you are unsure how to report. If the laws in your country are less clear about disclosing offshore financial holdings, you should consult with a lawyer specializing in international tax law and tax law your in your own country. Filing an incorrect or incomplete declaration or tax return may subject you to criminal penalties.[12]

Community Q&A

-

QuestionHow many yearly charges are there for account maintenance?

EricTop AnswererIt depends on the bank's fee schedule. Consult your bank to learn about the fees specific to your type of account.

EricTop AnswererIt depends on the bank's fee schedule. Consult your bank to learn about the fees specific to your type of account.

Warnings

- There are a number of fraudulent websites that claim to offer Swiss bank accounts for around $100 to $200. However, these websites are fraudulent and you will never get an account or see that money again.[13]⧼thumbs_response⧽

References

- ↑ http://foreignpolicy.com/2012/05/02/can-poor-people-open-a-swiss-bank-account/

- ↑ http://www.cnbc.com/id/26182063

- ↑ http://www.swiss-banking-lawyers.com/open-swiss-bank-account/

- ↑ http://www.premiumswitzerland.com/financial-news/banking/open-a-swiss-account.htm

- ↑ http://www.premiumswitzerland.com/financial-news/banking/open-a-swiss-account.htm

- ↑ http://www.premiumswitzerland.com/private-banking.htm

- ↑ http://nomadcapitalist.com/2015/06/03/what-is-a-private-bank-account-and-how-to-get-one/

- ↑ http://www.cnbc.com/id/26182063

- ↑ http://www.cnbc.com/id/26182063

- ↑ http://www.premiumswitzerland.com/financial-news/banking/international-tax-agreement.htm

- ↑ http://www.premiumswitzerland.com/financial-news/banking/international-tax-agreement.htm

- ↑ http://www.swiss-banking-lawyers.com/tax-compliance-voluntary-disclosure/

- ↑ http://www.swiss-banking-lawyers.com/open-swiss-bank-account/

About This Article

Before you open a Swiss private bank account, contact your bank of choice to learn whether or not you’ll need to open the account in person, and what their initial deposit is. Then, check whether or not you’re able to meet the bank’s minimum deposit amount, which can range from $250,000 to $1 million, sometimes even more. Next, gather your passport and proof of the legitimacy of your income, as well as any other documents requested by the bank. To learn more about opening a Swiss private bank account, like whether a named or numbered account is right for you, read on!