This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 413,831 times.

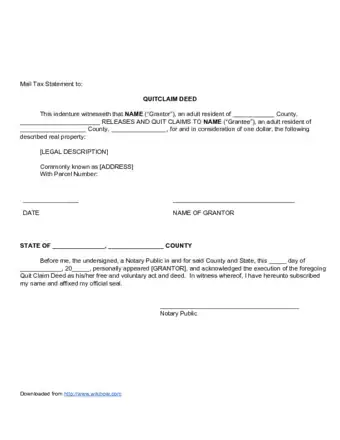

A quitclaim deed transfers the ownership of property without making any warranties.[1] For example, the person transferring the property doesn’t even warrant that they own the property. For this reason, quitclaim deeds are only appropriate when transferring property between close family members, such as divorcing spouses.[2] To draft a quitclaim deed, you should find the correct form and supply the requested information.

Steps

Drafting a Quitclaim Deed

-

1Seek help from an attorney or title company. Getting a quitclaim deed can be confusing and complex. It’s best to have the help of an attorney or title company to explain terminology, title transfers, and the like.

- You can get a referral for a real estate attorney by calling your nearest bar association.

-

2Find forms or templates. Your state or county may have a “fill in the blank” quitclaim deed you can use. Stop into your county’s land records office to check. This office is probably called the Recorder of Deeds office or something similar. A form may also be available on the county court website.

- Make sure to use a form approved for your state.

- These forms are usually uniform throughout the state, so you can use any county’s form.

Advertisement -

3Identify who prepared the deed. At the top of the document, there might be a line for you to enter who prepared the quitclaim deed.[3] Fill in this information.

-

4State who will receive the new deed. The deed might also have lines for you to enter the name and address of the person who should receive a copy of the deed after it is filed. This will be the person who is receiving the property. The land records office will send this person a copy as well as future tax statements.[4]

-

5Identify the parties. You will need to identify the “grantor,” who is the person transferring the property, and the “grantee,” who is the person receiving it. You can also provide their addresses or the county where they live.[5]

- You can obtain a document from the title company that will show the last legal owner, and who granted it to them. You can request a title search on the property to learn if the grantor is the legal owner and find out if the parcel is owned by more than one person. If the entire property is being transferred, then all owners need to transfer their ownership.

-

6Provide other key information. Your quitclaim deed should also contain the date of the transfer and the amount paid. Even if you paid no money for the land, the law usually requires that at least a dollar be listed.

- For example, your quitclaim deed might read: “For full and valuable consideration in the sum of One and no/100 Dollars, Kristen T. Jones, an adult resident of Big County, Michigan on this the 3rd day of June, 2017, does hereby bargain, sell, release, remise, quit claim and convey unto Michael T. Jones, an adult resident of Big County, Michigan, all right, title, and interest in and to the following described real estate….”[6]

-

7Include the legal description of property. This will be on the current deed, which you can find at the county land records office. Some quitclaim deeds will require a parcel number or the metes and bounds description, or both.[7]

-

8Include signature blocks. Generally, the grantor must sign. However, some states also require that the grantee and witnesses sign the quitclaim deed. Include signature lines and lines for the date.

-

9Add a notary block. Any template or form should have a notary block already typed onto it.[10] If you’re typing up your own form, then find an appropriate block online and insert it at the bottom of the page. Include a line for the notary to sign.

Executing Your Quitclaim Deed

-

1Sign in front of a notary.[11] You can find notaries at the courthouse, the land records office, or at most large banks. Take personal identification, such as a valid state-issued ID or passport. You will probably need to pay a small fee to have the quitclaim deed notarized.

-

2Complete other paperwork. Depending on your location, you might need to complete other forms before filing the deed. Ask the clerk at the land records office for all forms. For example, in California, you must fill out a Preliminary Change of Ownership Report (PCOR). You can get this form from the Recorder of Deeds office.[12]

-

3File the deed. Take the completed deed to the Recorder of Deeds in the county where the land is located. You’ll have to pay a small fee to record, usually less than $100.

- A deed is valid even if not recorded. However, recording the deed gives the public notice of the new owner of the property, and for that reason you should record it as soon as possible.[13]

-

4Send a copy to the grantee. The land records office might send a copy to the grantee, but you should go ahead and send it as well. Store your copy in a safe place with your other important papers.

Sample Quit Claim Deed

Expert Q&A

-

QuestionCan a husband give the property that he owns jointly with his wife, completely to his wife with a quit claim deed?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage If the couple is still married, then no - marriage laws require that they both own the home. If they have divorced, then yes, the deed can be quit-claimed to one or the other. This will not remove the individual from the mortgage, though, if that is the intended result.

If the couple is still married, then no - marriage laws require that they both own the home. If they have divorced, then yes, the deed can be quit-claimed to one or the other. This will not remove the individual from the mortgage, though, if that is the intended result. -

QuestionCan I do a quit claim deed on a property that I have a mortgage on?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage You can, but this does not relieve you of your responsibility to the mortgage. To remove an individual from a mortgage, the home must be sold or refinanced, depending on the situation.

You can, but this does not relieve you of your responsibility to the mortgage. To remove an individual from a mortgage, the home must be sold or refinanced, depending on the situation. -

QuestionIs a quit claim deed reversible? Can the original owner rescind the transfer?

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Real Estate Broker The original owner can't just take it back or rescind the quit claim. There may be some written stipulations attached to the quit claim that they may take back the property under certain events that have taken place for example, the death of the grantee, then the grantor takes back the property as stipulated in the granting. If the grantor grants 100% to the grantee without any stipulations, then the grantee has no obligations to the original grantor other than what a divorce or common law marriage settlement would dictate in a settlement of assets or a will or business partnership settlement. If there is no will, the property will go into probate for estate settlement by the executor or administrator and attorney and the original grantor will not have any claim unless they are an heir or have any rights under community property unless something was stipulated to have it revert back to the original grantor. A grantor can also stipulate that the property be granted to a third party on a certain event, for example, the grantor granted the quit claim for the life of the grantee then it reverts to their friend. Additionally, the person who receives the land, the grantee, can also quit claim it to someone else who may have rights under certain conditions. The grantee is now the grantor. The grantee can only transfer their ownership, if it is not joint tenancy on title but it is best to check with an attorney to find out what the rights are of the grantor and the grantee if it is in question. It can become confusing under certain circumstances.

The original owner can't just take it back or rescind the quit claim. There may be some written stipulations attached to the quit claim that they may take back the property under certain events that have taken place for example, the death of the grantee, then the grantor takes back the property as stipulated in the granting. If the grantor grants 100% to the grantee without any stipulations, then the grantee has no obligations to the original grantor other than what a divorce or common law marriage settlement would dictate in a settlement of assets or a will or business partnership settlement. If there is no will, the property will go into probate for estate settlement by the executor or administrator and attorney and the original grantor will not have any claim unless they are an heir or have any rights under community property unless something was stipulated to have it revert back to the original grantor. A grantor can also stipulate that the property be granted to a third party on a certain event, for example, the grantor granted the quit claim for the life of the grantee then it reverts to their friend. Additionally, the person who receives the land, the grantee, can also quit claim it to someone else who may have rights under certain conditions. The grantee is now the grantor. The grantee can only transfer their ownership, if it is not joint tenancy on title but it is best to check with an attorney to find out what the rights are of the grantor and the grantee if it is in question. It can become confusing under certain circumstances.

References

- ↑ https://www.legalzoom.com/articles/what-is-a-quitclaim-deed

- ↑ https://www.realtor.com/advice/sell/need-quitclaim-deed/

- ↑ http://register.shelby.tn.us/media/forms/QC.pdf

- ↑ https://saclaw.org/wp-content/uploads/2015/03/form-quitclaim-deed-instructions.pdf

- ↑ http://www.indianalegalservices.org/node/308/quitclaim-deeds

- ↑ http://register.shelby.tn.us/media/forms/QC.pdf

- ↑ https://saclaw.org/wp-content/uploads/2015/03/form-quitclaim-deed-instructions.pdf

- ↑ https://saclaw.org/wp-content/uploads/2015/03/form-quitclaim-deed-instructions.pdf

- ↑ http://www.indianalegalservices.org/node/308/quitclaim-deeds

- ↑ http://register.shelby.tn.us/media/forms/QC.pdf

- ↑ http://www.indianalegalservices.org/node/308/quitclaim-deeds

- ↑ https://saclaw.org/wp-content/uploads/2015/03/form-quitclaim-deed-instructions.pdf

- ↑ https://www.ohiobar.org/forpublic/resources/lawyoucanuse/pages/lawyoucanuse-262.aspx

- ↑ https://www.ohiobar.org/forpublic/resources/lawyoucanuse/pages/lawyoucanuse-262.aspx