This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

There are 12 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 17,131 times.

In recognition of the fact that farming is important to the economy and to the wellbeing of the American people, state and federal governments provide financial resources and assistance to farmers who have trouble making ends meet or want to upgrade or expand an existing farming operation. While these programs are limited, grants and loans are available for qualifying farms that are well-planned and run by individuals with the education and experience to ensure they succeed.[1] [2]

Steps

Collecting Documents and Information

-

1Analyze your background and location. Particularly to qualify for grants, you must be able to demonstrate that you have education and experience in the type of farming you want to conduct, and that such farming activities have been successful in the geographic area where your farm is located.[3]

- While you may think you're prepared to run a farm, you need to look at your background from the point of view of someone who might invest in your operation but knows nothing about you.

- Having education or experience in farming operations will provide the government agency with confidence that the money will be used well and wisely.

- Business education or experience running any small business also can be a benefit. Your farm is a business, and an understanding of basic business organization and financial principles will inspire confidence in agencies considering whether to give you a grant.

-

2Create a business plan. A loan or grant for a farm is treated much the same way as a loan or grant for a small business. To qualify for assistance, you must show that you are treating your farm as a business venture and expect ultimately to turn a profit from your work.[4] [5] [6]

- You can find a number of resources and templates for business plans online. Check on the U.S. Department of Agriculture (USDA) website as well as the website of the Small Business Association (SBA).

- Your state agricultural department and nonprofit farming organizations also may have resources that can help you build your farming business plan.

- While a farm business plan has many of the same components as any small business plan, the content of those components will be different.

- Generally, you will need sections that cover marketing, production and operations, human resources, and finances.

- Your financial section in particular must include detailed reports on your farm's income and assets, as well as projections of your farm's profit in future years.

Advertisement -

3Check your credit. Particularly if you are applying for a loan, your qualification will depend on your credit score. An established farm may have its own credit score, but typically it will be your personal credit history that determines whether you qualify for government-insured loans.[7] [8] [9]

- Check your credit report so you know what's on it. You're entitled to at least one copy of your credit report each year, and you can contact the credit bureau if there are any errors you need corrected.

- Go to annualcreditreport.com to get your free credit report as guaranteed by federal law. Keep in mind this is the only site endorsed by the federal government. Other sites may claim they're giving you a free credit report but require you to purchase a credit monitoring subscription.

- If you have an established farm – or perhaps you're taking over a family farm – it may have its own credit history, particularly if the farm has existing loans or lines of credit under the farm's employer identification number.

-

4Gather ownership and legal documents. As part of your grant or loan application package, you typically must provide documents showing that you own any land, livestock, or equipment that you intend to use in your farming business.[10] [11]

- For example, if you own the land on which you want to operate your farm, you'll need copies of the deed to include with your applications. That land is an asset for your farm.

- If you're leasing farmland, you'll probably need copies of your leases as well. The same goes for any leases of major farm equipment.

Applying for Grants

-

1Explore state and federal opportunities. Both state and federal governments have grant programs for various aspects of farming. Since you don't have to pay grant money back provided you meet the program requirements, the grant application process typically is extremely competitive.[12]

- The USDA website has a list of links to all state departments of agriculture. From the home page, search for state departments of agriculture to bring up the list.

- You also can click on the Beginning Farmers link from the USDA home page to access information about grants specifically available for those who are just starting their farming operation.

- Keep in mind that grants have strict deadlines and specific budgets. If you've looked at the information for a particular grant and decided you want to apply, write down this information in a prominent place so you have it in mind as you work on your application.

- State departments may have more specific programs that would suit your needs, while federal opportunities tend to be broader in application.

-

2Complete your grant applications. Read through the grant application forms carefully before you begin filling them out, so you have a solid understanding of the information that will be required. Through your application, you want to paint a picture of a farmer who meets the requirements and is worthy of the money.[13] [14]

- The grant application will require you to provide specific information about your farming business. This information typically will be included in the business plan you created, so you can copy it from there.

- Focus on the specific purpose of the grant. For example, if you're applying for a sustainable agriculture grant, you should focus on the sustainable methods you're using and your financial needs with implementing those methods.

- From the purpose, you'll develop your grant proposal. This proposal describes the goals you hope to accomplish with the specific amount of grant money you're requesting.

- Grants for beginning farmers typically are only available to operations that have not yet started or have only been going for a few years. Check the requirements carefully to make sure your farm falls within the grant's limits.

- Keep in mind that grants have limited budgets. Generally, you don't want to count on grants to cover all of your financial needs – some programs may offer only a few hundred dollars, meaning you typically still would need to look for loans to cover the rest of your need.

-

3Submit your grant applications. After you've finished your grant applications, make copies before you send them to the appropriate government agency. Since grants are highly competitive, make sure you're sending your application well in advance of any deadline provided.[15]

- Grants that require you to submit additional documentation, such as a copy of your business plan or a financial statement, typically will have a checklist of documents that must be included along with the application form itself.

- If you're mailing a paper application, make sure you're leaving enough time for it to get there in advance of the deadline. Grant deadlines typically run from the date the department receives your application, not the date of the postmark.

- Some grant applications can be accessed and completed online. If you're completing an online application, make sure you make a copy of your application for your records before you submit it.

-

4Wait for your application to be processed. Grant applications themselves can be quite lengthy, and the volume of applications may mean it will take several months before you find out whether your application has been approved.[16]

- The grant information may include an approximate processing time. If it does, you might make this on your calendar – but don't treat it as a hard deadline.

- Keep in mind that any processing time estimates typically don't begin until the date the grant's application acceptance period closes.

- You may be contacted by someone from the department who wants to ask you questions or needs additional information to complete the processing of your application.

-

5Submit the required reports. If you are awarded a grant, you must submit regular reports to the government agency that provided the grant. These reports detail how the grant money is being spent and provide a snapshot of the financial health of your farm.[17]

- Federal grants typically have standard reports that are required, regardless of the amount of money you receive. Expect to file more reports for a multi-year grant than for a single disbursement.

- For all grants, you must file a final narrative report that details your activities, production, and how you met the goals you set forth in your grant proposal.

- Multi-year grants typically also require interim reports, including budget reports that detail how you spent the grant money each year and the progress you've made toward the goals outlined in your application.

Applying for Loans

-

1Evaluate federal and state loan products. More government assistance for a farm typically is available in the form of loans rather than grants. Government-insured or guaranteed farm loans have benefits you wouldn't get from a traditional small business loan, such as lower interest rates and more flexible payment terms.[18] [19] [20]

- Federal farm loans are administered by the Farm Service Agency (FSA), which is part of the USDA. Most of these loans are intended as temporary stop-gaps to get your farm to a point that you can be approved for a traditional commercial loan to meet any ongoing funding needs.

- These loans often are restricted to applicants who wouldn't otherwise qualify for a traditional commercial loan, which can make them a good fit for you if your credit is lacking.

- However, keep in mind that some loans are only available to farmers who are unable to meet their funding needs through traditional commercial lenders.

- The government department will make its own assessment whether commercial lending is available to you, but it's worth doing all you can to meet your funding needs through private lenders before applying for government loans.

-

2Consider farm bank loans. Farm banks are defined as those that handle more farm real estate and production loans than the average bank. Many of them include the word "farm" in their name. You can find a list of these banks on the agricultural banking page of the American Bankers Association website.[21] [22]

- While these are traditional commercial loans, farm banks have a better understanding of and commitment to farmers and farming businesses.

- As a result, farm banks may be more willing to work with you on specific farm-related issues where a traditional commercial bank would be unforgiving.

- For example, a farm bank typically understands that farming income may be seasonal, meaning that your payments on the loan would fluctuate through the year.

-

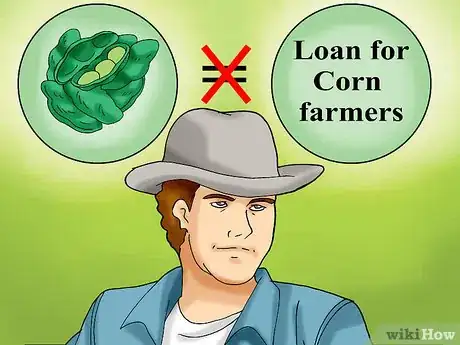

3Identify loans that would meet your needs. Loans may be restricted to certain types of farming activities, or to certain phases of farm development. Some loans may only be available for beginning farms, while others are available for existing farms that have been in operation for several years.[23] [24]

- Some loans also may be restricted to specific regions. For example, federal-guaranteed loans may be available only to farmers in certain parts of the country, while loans insured or guaranteed by state governments or nonprofit organizations may be restricted to specific counties.

- Read the loan requirements carefully to make sure your farm qualifies for the loan offered. Some loans may have reporting requirements, similar to grants, that are designed to confirm you're using the proceeds of the loan for the purpose intended.

- Avoid applying for a loan that you don't need just because it is available. For example, if you intend to grow soybeans, don't apply for a loan for corn farmers. If the lender discovers that you are not a corn farmer, you may incur financial penalties as a result.

- Additionally, the government may bar you from applying for government loans or other financial assistance in the future if you falsify information related to your farm on your loan application.

-

4Complete your loan application. The farm loan application will require you to provide various information about yourself and your financial history, as well as your farming activities and the purpose for which you are requesting the loan.[25] [26]

- The application will be more in depth than any applications you may have completed for credit cards or consumer loans. The information you'll have to provide is similar to what you'd have to provide if you were taking out a commercial loan for a small business.

- You'll be expected to list all assets, including their value, as well as all debts, including both farm-related and personal debts.

- You also may be required to submit a full business plan as well as detailed financial reports regarding your farming operations.

- If you've incorporated your farm, or are operating it as a partnership or other business entity, the lending institution typically will require you to submit copies of your business organization paperwork, including articles of incorporation and partnership or operating agreements.

-

5Submit your loan application. Once you've completed the application form for the loan, gather any documents that must accompany your application and make a copy of the entire package for your records before sending it to the appropriate government agency or lending institution.[27] [28]

- Typically government loans are serviced by a particular bank or lending institution in your area. This means your application paperwork should go there – not to the government agency that guarantees or insures the loan.

- The application should include an address to which the completed paperwork should be sent. If you're completing your application online, you may be able to submit it online as well.

- If you submit your application online, the bank or lending institution typically will provide you with an address where you can send any documents for which you don't have digital copies to attach and send electronically.

-

6Comply with your loan's terms and conditions. When your loan is approved, the bank that services your loan will provide you with a document that outlines your responsibilities as a loan recipient. This may involve submitting financial reports or other information on a regular basis.[29] [30]

- Read through the terms carefully and make sure you understand the length of the loan, the interest rate, and how your payments are structured.

- Particularly if the loan is for a specific purpose, you typically must be able to prove that you are using the loan funds for that purpose.

- To this end, you may be required to submit budgeting or financial reports periodically through the life of your loan.

- Your packet that includes the terms and conditions of your loan also typically includes contact information for the agent responsible for your loan.

- Keep this information in a safe place with your financial records so you can call them if you have any difficulty making your loan payments. They typically will be willing to work with you if you contact them as soon as possible, preferably before the payment is due.

References

- ↑ https://www.nal.usda.gov/afsic/grants-and-loans-farmers

- ↑ http://www.fsa.usda.gov/programs-and-services/farm-loan-programs/index

- ↑ http://extension.psu.edu/publications/ua371

- ↑ https://www.nal.usda.gov/ric/small-farm-funding-resources

- ↑ https://www.sba.gov/starting-business

- ↑ http://extension.psu.edu/publications/ua371

- ↑ http://extension.psu.edu/publications/ua371

- ↑ http://www.fsa.usda.gov/Internet/FSA_File/fsa_br_01_web_booklet.pdf

- ↑ https://www.consumer.ftc.gov/articles/0155-free-credit-reports

- ↑ https://www.myfcsfinancial.com/2013/04/documents-needed-for-farm-loan/

- ↑ https://nifa.usda.gov/funding-opportunity/beginning-farmer-and-rancher-development-program-bfrdp

- ↑ http://www.beginningfarmers.org/funding-resources/

- ↑ https://nifa.usda.gov/funding-opportunity/beginning-farmer-and-rancher-development-program-bfrdp

- ↑ http://www.beginningfarmers.org/funding-resources/

- ↑ https://nifa.usda.gov/funding-opportunity/beginning-farmer-and-rancher-development-program-bfrdp

- ↑ https://nifa.usda.gov/funding-opportunity/beginning-farmer-and-rancher-development-program-bfrdp

- ↑ http://www.rwjf.org/en/how-we-work/grants/grantee-resources/reporting-and-accounting-information.html

- ↑ http://www.cfra.org/renewrural/governmentprograms

- ↑ http://www.beginningfarmers.org/funding-resources/

- ↑ http://www.fsa.usda.gov/programs-and-services/farm-loan-programs/index

- ↑ https://www.nal.usda.gov/ric/small-farm-funding-resources

- ↑ http://www.fsa.usda.gov/Internet/FSA_File/fsa_br_01_web_booklet.pdf

- ↑ http://www.beginningfarmers.org/funding-resources/

- ↑ http://www.fsa.usda.gov/Internet/FSA_File/fsa_br_01_web_booklet.pdf

- ↑ http://www.fsa.usda.gov/programs-and-services/farm-loan-programs/index

- ↑ http://www.fsa.usda.gov/Internet/FSA_File/fsa_br_01_web_booklet.pdf

- ↑ http://www.fsa.usda.gov/programs-and-services/farm-loan-programs/index

- ↑ http://www.fsa.usda.gov/Internet/FSA_File/fsa_br_01_web_booklet.pdf

- ↑ http://www.fsa.usda.gov/programs-and-services/farm-loan-programs/index

- ↑ http://www.fsa.usda.gov/Internet/FSA_File/fsa_br_01_web_booklet.pdf