This article was co-authored by wikiHow staff writer, Jennifer Mueller, JD. Jennifer Mueller is a wikiHow Content Creator. She specializes in reviewing, fact-checking, and evaluating wikiHow's content to ensure thoroughness and accuracy. Jennifer holds a JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 19,819 times.

Learn more...

LIC policies are life insurance policies issued by the Life Insurance Company of India. Your policy reaches maturity at the date stated on your policy bond – this is the date on which the cash value of your policy is equal to your death benefit. To close your policy before this date, go through the process of surrendering it to LIC. The amount of money you'll get for your policy depends on how long you've been paying premiums. However, be aware that you will lose money if you surrender your policy before it reaches maturity.[1]

Steps

Calculating Your Surrender Value

-

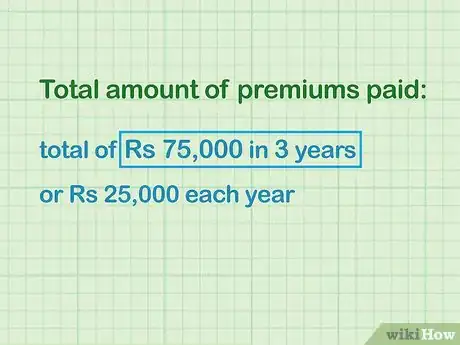

1Total the amount of premiums you've paid and for how long. LIC only offers surrender value after you've been paying premiums for 3 years. If you've been paying premiums for less time than that, you can still surrender your policy, but you won't get any money for it.[2]

- Find your original policy bond. You will need to send a copy of it with your request to surrender your policy.

- Collect receipts for all premium payments. You may also need to include these with your request to surrender your policy.

-

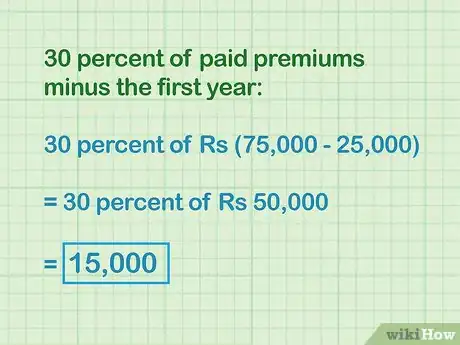

2Find 30 percent of your paid premiums minus the first year. If you've been paying premiums for at least 3 years, you are entitled to a guaranteed surrender value. If you have a regular premium policy, the guaranteed surrender value is 30 percent of your paid premiums, not including the premiums you paid for the first year.[3]

- For example, if you paid a total of Rs 75,000 in premiums for 3 years, or Rs 25,000 each year, you would be entitled to 30 percent of Rs 50,000. The surrender value of your policy would be Rs 15,000.

Advertisement -

3Determine if you're entitled to any additional payment. If you've been paying premiums for more than 3 years, you may also be entitled to the surrender value of any vested bonuses on your policy. The percentage of the surrender value varies among insurers and types of policies. Generally, it is between 16 and 35 percent of the total amount of any vested bonuses.[4]

- You can find out if you have any vested bonuses by checking your policy status. You can check your policy status in the branch that services your policy. In some areas, you may also be able to check your policy status through your online account.[5]

Tip: There are surrender value calculators available online. However, these are not affiliated with LIC and there is no guarantee that they are correct. Using them simply gives you a basic idea of what you might get for your policy.

-

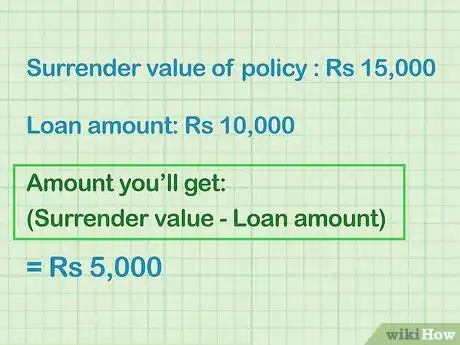

4Subtract any loans from your total surrender value. If you took out a loan against the value of your LIC policy, the balance you owe on that loan will be paid before you are given any money for surrender of your policy. If your loan is more than your surrender value, you may end up having to pay money to surrender your policy.[6]

- For example, if the surrender value of your policy is Rs 15,000, but you've taken out a loan against your policy with a current balance of Rs 10,000, you would only get Rs 5,000.

Surrendering Your Policy

-

1Complete an application for surrender value. Go to any nearby LIC branch to get a copy of the application. You must fill out and submit the paper application. On the application, provide your policy number, identifying information, and bank information so the surrender value can be transferred to your account.[7]

- You may also provide bank information by enclosing a canceled check with your application.

Variation: If you're mailing your application for surrender value to the LIC, include a brief cover letter that describes the documents enclosed and provides contact information.

-

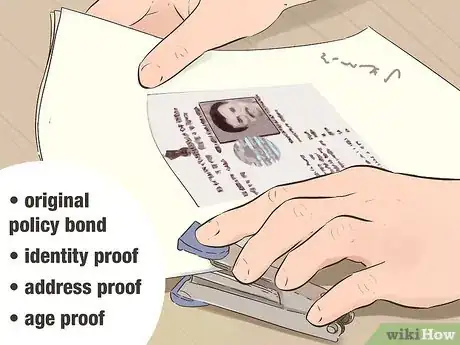

2Gather supporting documents for your application. Along with the application, you'll need your original policy bond, proof of identity, proof of your address, and proof of your age. If you're mailing your application, make photocopies of government-issued photo identification documents.[8]

- You may also want to make a copy of your latest account status to include with your application.

-

3Sign your application before a Gazetted officer. Once you've completed your application, your signature must be witnessed by a Gazetted officer, who will verify your identity and confirm your signature with a seal.[9]

- Magistrates, Justices of the Peace, Block Development Officers, the principal or headmaster of your local high school, and agents of nationalized banks can also verify your identity and signature.

-

4Submit your application to the LIC branch where you bought your policy. Your application for surrender value can only be processed in your "home branch" where you originally set up your policy. If you live too far away from that branch to take in your application in person, you can mail it.[10]

- If you're unsure of the mailing address for your home branch, use the LIC branch locator, available online at https://www.licindia.in/LOCATOR/Branch.

-

5Confirm transfer of funds to your bank. Once LIC receives your application it will begin the process of closing your account and transfer the surrender value amount to the bank account you provided on your application. You should receive your funds within 10 days of LIC's receipt of your application.[11]

- You may get a notice when LIC receives your application. To be certain, use registered mail or some other method that allows you to track its progress so you'll know when your application has been received.

References

- ↑ https://www.licindia.in/Customer-Services/Policy-Guidelines

- ↑ https://www.licindia.in/Customer-Services/Policy-Guidelines

- ↑ https://www.businesstoday.in/moneytoday/insurance/surrendering-an-endowment-policy-calculate-value-before-that/story/187458.html

- ↑ https://www.onlinelic.co.in/lic-surrender-value-calculator/

- ↑ https://www.licindia.in/Customer-Services/Policy-Guidelines

- ↑ https://www.basunivesh.com/wp-content/uploads/2016/12/Download-LIC-Policy-Surrender-Form-No.5074.pdf

- ↑ https://www.basunivesh.com/wp-content/uploads/2016/12/Download-LIC-Policy-Surrender-Form-No.5074.pdf

- ↑ https://www.bankbazaarinsurance.com/life-insurance/how-to-surrender-your-lic-policy.html

- ↑ https://www.basunivesh.com/wp-content/uploads/2016/12/Download-LIC-Policy-Surrender-Form-No.5074.pdf