This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 12 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 297,251 times.

In a divorce, the marital residence [1] is often the primary asset that the couple has to divide. There several options. One is for one spouse to take the house and the other to take a larger share of other assets. The house can be sold and the proceeds split, or one spouse can buy out the other spouse's share of the home's equity.

Steps

Evaluating your options

-

1Analyze your mortgage documents. Before you decide to do an equity buy-out in your divorce, you need to know the exact pay-off balance of the mortgage. You also need to know the breakdown of the payment and how much goes to Principal-Interest-Taxes-Insurance (PITI). [2]

- If you have less than 20 percent equity in the home, you may also be paying private mortgage insurance (PMI) of .25 to 2 percent per year. [3]

- Contact your homeowner's insurance carrier. You may be receiving discounts because you bundle multiple vehicles with your home or paying a penalty because one spouse has a history of claims. Since your insurance is part of your mortgage PITI, a change in the insurance can change the payment.

-

2Gather income and credit information. The spouse who wants to keep the house needs to be realistic. A true equity buy-out, paying your spouse a lump sum for his share of the equity and removing his name from the mortgage and the deed, means you will have to qualify for a mortgage on your own. Mortgage lenders typically use 28 percent of the borrower's gross income as a benchmark. [4] You can obtain a free copy of your personal credit report from the three primary credit reporting companies thanks to the Fair Credit Reporting Act (FCRA). [5] [6]

- The credit report through the FCRA will not include your credit score. The report is more critical, you can check it for inaccurate information and any issues you might be able to resolve before you attempt to refinance. There are several online tools for estimating your credit score. Look for one that does not require you to provide credit card information or sign up for a subscription to questionable credit monitoring services.

Advertisement -

3Order an appraisal on the house. Whether the housing market is volatile or sluggish, you need to know the current market value of the house, regardless of the mortgage. Tidy up the house and property. A solid appraisal will help with the refinancing. [7]

-

4Investigate comparable properties. Your appraiser will look at the neighborhood Comparative Market Analysis, CMA or "comps," [8] but it doesn't hurt to look into them on your own. You can check out what houses similar to yours are on the market for, but the key is not asking price, it is selling price. A real estate agent can run a report for you, or there are online tools for estimating the comps in your area.[9]

-

5Make a decision. Equity buy-outs offers risks and rewards for both spouses. For the one who keeps the house, a buy-out means assuming the entire mortgage, but reaping the rewards if the house increases in value. For the spouse giving up his share, it means getting out from under the risk and burden of the mortgage and getting a fixed share without having to worry about the future of the housing market in that neighborhood.

- The equity is calculated as the appraised value of the house minus the balance on the mortgage.

- If you've owned the house for less than five years, unless you made a substantial down payment or living in a hot housing market, you may be surprised at how little equity you have. For example, if you financed $250,000 for 30 years at 4.50 percent, after 5 years, you will only have paid off $22,000 or 9 percent of your loan.[10]

- Compare current mortgage terms with your own. If interest rates have dropped, this may be a good time to look into refinancing. However, if rates have gone up, you may want to look at other alternatives than a new mortgage.

-

6Evaluate other assets and options. If getting a mortgage on your own may be difficult or unfairly expensive, consider liquidating or trading other marital assets to pay off your spouse's share of the equity.

- For example, if there is $22,000 in equity and it's not a good time to refinance, then an $11,000 loan or distribution from a savings account, or giving up an $11,000 claim on your spouse's 401K can be substituted for the equity cash payment. In amicable divorces, the judge will look at the fundamental fairness of the property agreement and accept most reasonable agreements.

- Consider a co-ownership agreement where one spouse occupies the house and pays the entire PITI obligation. However, if one defaults, the other partner must assume the mortgage or lose ownership of the property.

- Co-ownership works well in amicable divorces where there are short-term goals, such as keeping the home so that teen children can finish school or the occupying spouse finishes school or job-training to improve income enough to take on a solo mortgage.

Executing an Equity Buy-Out

-

1Allow the court to order the terms of the buy-out. If your divorce is contested or communication breaks down during the divorce process, you can let the court craft the terms of the buy-out and force your ex-spouse to comply with documentation, deed, and asset transfer requirements.

- It is better to make every effort to work it out with your spouse, even if you have to split the cost and sit down with an attorney to craft an equity buy-out agreement. The court's decision will not take personal feelings, market conditions, and future plans into account. The result may be a blunt force order with end results that don't work well for either party.

-

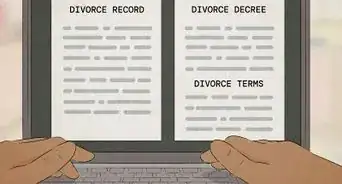

2Learn about community property laws. If refinancing with a cash payment is the best option, you will need to time the new mortgage correctly. If you live in a community property state, refinancing can be complicated unless you wait until the divorce is final.[11]

- If you must refinance immediately, consult a real estate attorney about the ramifications of community property laws on the transaction. Unless handled correctly, the refinanced loan could be considered a joint debt, defeating the purpose of the equity split.

-

3Create a co-ownership agreement for a fixed time until the divorce is settled and final. Both names remain on the deed and the loan, but the spouse who is staying in the house takes over the payments and receives credit for the additional equity that accrues during the co-ownership.

-

4Decide on the best way to refinance. Assuming you have the income and credit needed to refinance, you will have several different loan options to consider.

- A conventional rate/term refinance trades the old mortgage for a new one. The balance of the old mortgage becomes the new loan amount. The problem with this type of loan is that you will have to come up with the cash to pay your spouse for his share of the equity. [12]

- A cash-out refinance allows you to finance a combination of the outstanding balance and the equity, receiving a cash payment. This type of loan requires a favorable loan-to-value ratio and solid credit. [13] There may be extra fees or a higher interest rate for this type of loan.

- If your ex-spouse is comfortable with his name remaining on the existing mortgage, you can take a home equity loan in your name to raise the needed cash payment. This is a good option if the existing mortgage has exceptionally good terms and is within less than three to five years of being paid off.

-

5Transfer the deed. Once the divorce is final and the equity payment is complete, the vacating spouse needs to execute a Quit-Claim deed in favor of the person keeping the house. Blank forms are available at most office supply stores or an attorney can draw one up for a reasonable cost. [14] The deed should be filed with the county recorder's office as soon as possible. There is a small fee to file the document, usually under $20.

References

- ↑ http://definitions.uslegal.com/m/marital-residence/

- ↑ http://www.investopedia.com/terms/p/piti.asp

- ↑ http://www.investopedia.com/terms/p/privatemortgageinsurance.asp

- ↑ http://www.investopedia.com/terms/p/piti.asp

- ↑ http://www.consumer.ftc.gov/articles/0155-free-credit-reports

- ↑ https://www.annualcreditreport.com/index.action

- ↑ http://blogs.wsj.com/developments/2011/10/11/ten-tips-for-high-value-home-appraisals/

- ↑ http://www.biggerpockets.com/rei/real-estate-comps-house-value/

- ↑ http://www.zillow.com/homes/

- ↑ http://www.bankrate.com/calculators/mortgages/amortization-calculator.aspx

- ↑ http://www.bankrate.com/finance/mortgages/pay-for-divorce-with-cash-out-refinancing.aspx

- ↑ http://www.investopedia.com/articles/personal-finance/061115/cash-out-vs-rateterm-mortgage-refinancing-loans.asp

- ↑ http://www.bankrate.com/finance/mortgages/pay-for-divorce-with-cash-out-refinancing.aspx

- ↑ http://www.investopedia.com/articles/personal-finance/051614/five-things-know-about-quitclaim-deeds.asp

About This Article

It can be stressful to make living arrangements during a divorce, but If you want to keep your house, all you need to do is buy out your spouse’s home equity share. It's best to do this if you know you can afford to pay your spouse a lump sum and if you're able to qualify for a mortgage on your own. Typically, your mortgage payments should be no more than 28 percent of your income to be approved. When you decide to buy home equity, try to decide on a co-ownership agreement until the divorce is settled, like who will live in the house and who will take over payments. Then, once the divorce is final you can refinance the house and transfer the house deed. To learn how to order an appraisal on your house, read more from our Legal co-author!

-Step-12.webp)