X

This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

This article has been viewed 153,682 times.

Learn more...

Most people find it hard to squeeze a trip to the bank into their schedule. That’s why online banking makes it a lot easier for busy people by letting them do their banking transactions right from the comfort of their own homes or workplaces. If you haven’t discovered online banking yet, rest assured, it’s easy and convenient.

Steps

Part 1

Part 1 of 3:

Registering with Your Bank’s Online Banking Service

-

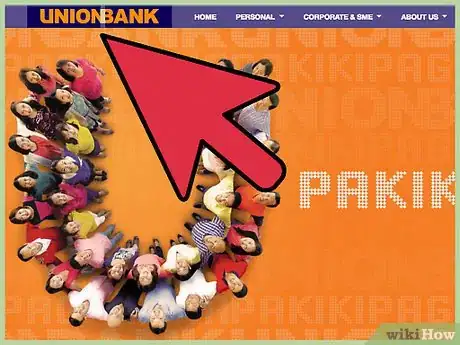

1Go to your bank’s website. All the major banks and practically all of the minor banks offer online banking services. Open your web browser on your computer and visit your bank’s website.

-

2Select “online banking." Browse the homepage of your bank’s website and click on the link that says “online banking." If you don't see the words "online banking" specifically, just look for the button that says "login."Advertisement

-

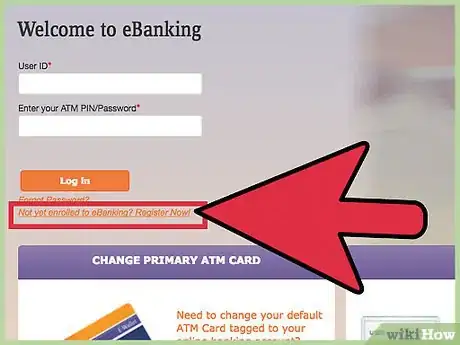

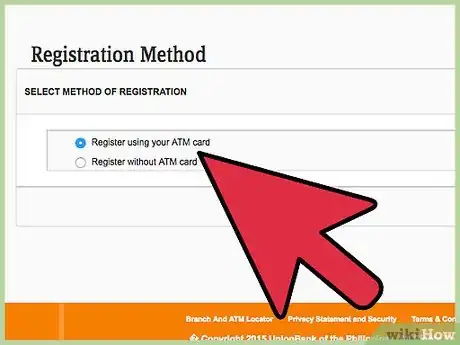

3Register for an account. Click either the “enroll” or “sign up” buttons on the homepage to go to the registration section. Enter your basic bank information like your name, email address, billing address and bank account number.

-

4Choose your primary account. If you have multiple accounts in one bank, you'll need to choose which one you’ll use as your primary online bank account for the service. You can add or remove your other accounts once you've finished signing up

Advertisement

Part 2

Part 2 of 3:

Activating Your Service

-

1Go to your bank. Some banks will only activate your account if you verify your identity in person. If this is the case with your bank, go to the nearest branch of your bank and speak to the representative that handles online banking services. Provide the username/email address and password you used to register and they will activate the service on their system.

-

2Activate your online banking service over the phone. Some banks let you activate your online banking service by calling their customer service department and talking to a representative. You will need to provide identifying information such as your Social Security or driver's license number.

-

3Activate your account at an ATM. Some banks will also let you activate your service at an ATM. The procedure isn't as standardized for ATM activations, so just follow the instructions specific to your bank. You can find them online after you've completed online banking registration.

-

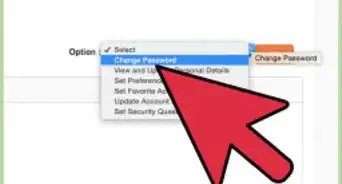

4Activate your account online. If your bank allows and you prefer, you can activate your online bank account online. If your bank does allow this, you'll either need to create a username or use one provided by your bank (an account number, for instance) you created along with a password.

- It's best to create a password that isn't easily guessable. Use a combination or capital and lowercase letters, numbers, and special characters.

- When you activate your account, a lot of banks will have you create (or answer) security questions. These are special questions created by you or the bank which will have answers unique to you, such as the name of your high school mascot or the color of your first car.

Advertisement

Part 3

Part 3 of 3:

Accessing Your Bank Account Online

-

1Go to your bank’s website. Whenever you want to access your account, all you have to do is open your web browser and visit your bank’s website. After the page loads, look for the tab or button that says “online banking."

- Click the link that says “online banking” or "login" to access your account.

-

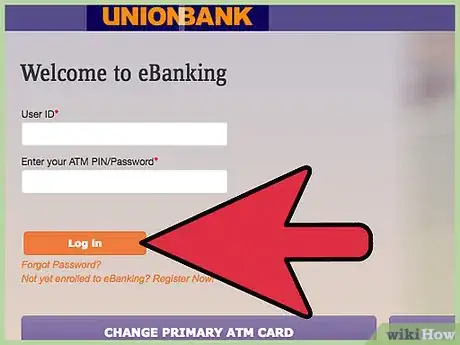

2Sign in. Enter your online banking username/email address and password on the text field provided and click the “Sign In” or “Log In” button. If you can't remember your password, follow the password reset link below the text box.

-

3Wait for the site to open your account. You should be able to see all your account details like available balances, recent transactions and pending payments.[5]

-

4Add a mobile app. Almost all banks, large and small, will have a mobile app. Once you've gotten comfortable with online banking, download your bank's mobile banking app. Although the mobile interface might be a little different than the desktop interface, you'll login just like normal. Using the mobile apps allows you the freedom of being able to access your account anywhere you have a mobile data connection.

-

5Use your account at your convenience. Online banking is convenient not only because of portability, but because it allows you to do things like transfer money between accounts, set up online bill pay, or monitor the posting of a deposit.

- If you find yourself confused by any online banking features, most banks and credit unions have chat assistance to guide you every step of the way.

Advertisement

References

- ↑ https://www.commercebank.com/personal/online-services/online-banking/activate-online-banking.asp

- ↑ https://www.pnc.com/en/personal-banking/banking/online-and-mobile-banking.html

- ↑ https://www.bankofamerica.com/onlinebanking/online-banking.go

- ↑ https://www.usbank.com/online-banking/manage-your-money-online.html

- ↑ https://www.commercebank.com/personal/online-services/online-banking/activate-online-banking.asp

About This Article

Advertisement