Section 4

Tax Considerations

Book

Version 3

By Boundless

By Boundless

Boundless Finance

Finance

by Boundless

4 concepts

Corporate Taxes

Corporate taxes are levied on the income of various entities, stemming from their business operations.

Tax Deductions

A tax deduction is a reduction of the amount of income subject to tax.

Depreciation

Depreciation is the allocation of expenses associated with assets that contribute to operations over several periods.

Individual Taxes

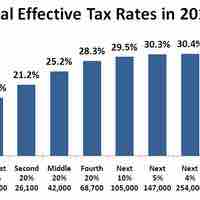

The U.S. federal, state and local governments levy taxes on individuals based on income, property, estate transfers, and/or sales transactions.