Market Value Added

Market Value Added (MVA) is the difference between the current market value of a firm and the capital contributed by investors.

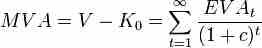

If the MVA is positive, the firm has added value. If it is negative, the firm has deminished value. The amount of value added needs to be greater than the firm's investors could have achieved investing in the market portfolio, adjusted for the leverage (beta coefficient) of the firm relative to the market. The formula for MVA is:

MVA

Calculation of MVA

where: MVA is market value added, V is the market value of the firm, including the value of the firm's equity and debt, and K is the capital invested in the firm.

Economic Value Added

In corporate finance, Economic Value Added or EVA, is an estimate of a firm's economic profit – being the value created in excess of the required return of the company's investors (being shareholders and debt holders). Quite simply, EVA is the profit earned by the firm, less the cost of financing the firm's capital. The idea is that value is created when the return on the firm's economic capital employed is greater than the cost of that capital.

EVA is net operating profit after taxes (or NOPAT) less a capital charge, the latter being the product of the cost of capital and the economic capital.

The basic formula is: EVA = (r - c) * K = NOPAT - c * K

where r is the return on investment capital (ROIC); c is the weighted average of cost of capital (WACC); K is the economic capital employed; NOPAT is the net operating profit after tax.

The firm's market value added, or MVA, is the discounted sum (present value) of all future expected economic value added: MVA = Present Value of a series of EVA values.

MVA and EVA

MVA is the present value of a series of EVA values.

More enlightening is that, since MVA = NPV of Free cash flow (FCF) it follows, therefore, that the NPV of FCF = PV of EVA since after all, EVA is simply the re-arrangement of the FCF formula.