Concept

Version 5

Created by Boundless

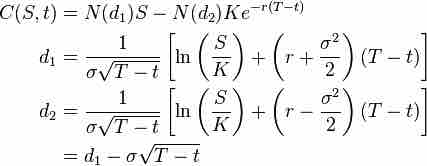

Black-Scholes Formula

Black-Scholes Model

The Black-Scholes formula where S is the stock price, C is the price of a European call option, K is the strike price of the option, r is the annualized risk-free interest rate, sigma is the volatility of the stock's returns, and t is time in years (now=0, expiry=T).

Source

Boundless vets and curates high-quality, openly licensed content from around the Internet. This particular resource used the following sources: