The money multiplier in theory makes a number of assumptions that do not always necessarily hold in the real world. It assumes that people deposit all of their money and banks lend out all of the money they can (they hold no excess reserves). It also assumes that people instantaneously spend all of their loans. In reality, not all of these are true, meaning that the observed money multiplier rarely conforms to the theoretical money multiplier.

Excess Reserves

First, some banks may choose to hold excess reserves. In the decades prior to the financial crisis of 2007-2008, this was very rare - banks held next to no excess reserves, lending out the maximum amount possible. During this time, the relationship between reserves, reserve requirements, and the money supply was relatively close to that predicted by economic theory. After the crisis, however, banks increased their excess reserves dramatically, climbing above $900 billion in January of 2009 and reaching $2.3 trillion in October of 2013 . The presence of these excess reserves suggests that the reserve requirement ratio is not exerting an influence on the money supply.

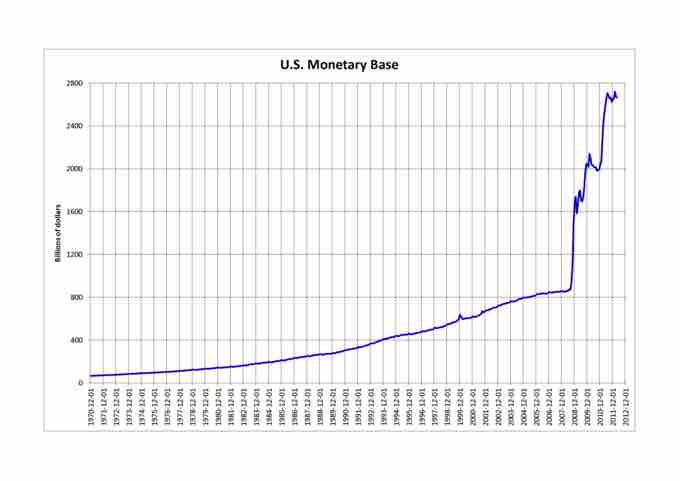

U.S. Monetary Base

The monetary base is the sum of currency and reserves held in accounts at the central bank. After the financial crisis the monetary base increased dramatically: the result of banks starting to hold excess reserves as well as the central bank increasing the supply of reserves.

Cash

Second, customers may hold their savings in cash rather than in bank deposits. Recall that when cash is stored in a bank vault it is included in the bank's supply of reserves. When it is withdrawn from the bank and held by consumers, however, it no longer serves as reserves and banks cannot use it to issue loans. When people hold more cash, the total supply of reserves available to banks goes down and the total money supply falls.

Loan Proceeds

Third, some loan proceeds may not be spent. Imagine that the reserve requirement ratio is 10% and a customer deposits $1,000 into a bank. The bank then uses this deposit to make a $900 loan to another one of its customers. If the customer fails to spend this money, it will simply sit in the bank account and the full multiplier effect will not apply. In this case, the $1,000 deposit allowed the bank to create $900 of new money, rather than the $10,000 of new money that would be created if the entire loan proceeds were spent.