Section 3

Progressive, Proportional, and Regressive Taxes

Book

Version 3

By Boundless

By Boundless

Boundless Economics

Economics

by Boundless

4 concepts

Comparing Marginal and Average Tax Rates

Taxes can be evaluated based on an average impact or a marginal impact and can be categorized as progressive, regressive, or proportional.

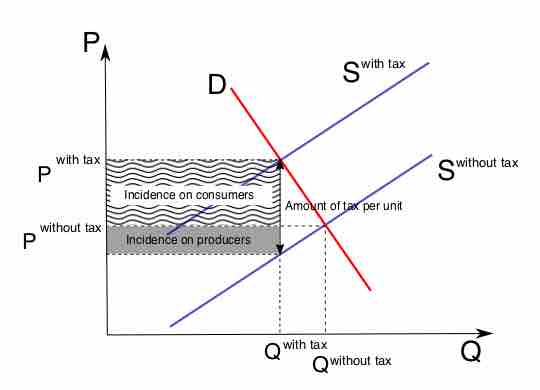

Tax Incidence, Efficiency, and Fairness

Tax incidence is the analysis of the effect of a particular tax on the distribution of economic welfare.

Tax Incidence and Elasticity

Tax incidence or tax burden does not depend on where the revenue is collected, but on the price elasticity of demand and price elasticity of supply.

Trading off Equity and Efficiency

Taxes may be considered equitable if they are administered in accordance with the definition of either horizontal or vertical equity.