Monopolistically competitive markets are less efficient than perfectly competitive markets.

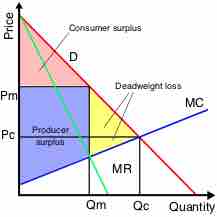

Producer and Consumer Surplus

In terms of economic efficiency, firms that are in monopolistically competitive markets behave similarly as monopolistic firms. Both types of firms' profit maximizing production levels occur when their marginal revenues equals their marginal costs. This quantity is less than what would be produced in a perfectly competitive market. It also means that producers will supply goods below their manufacturing capacity.

Firms in a monopolistically competitive market are price setters, meaning they get to unilaterally charge whatever they want for their goods without being influenced by market forces. In these types of markets, the price that will maximize their profit is set where the profit maximizing production level falls on the demand curve.This price exceeds the firm's marginal costs and is higher than what the firm would charge if the market was perfectly competitive. This means two things:

- Consumers will have to pay a higher price than they would in a perfectly competitive market, leading to a significant decline in consumer surplus; and

- Producers will sell less of their goods than they would have in a perfectly competitive market, which could offset their gains from charging a higher price and could result in a decline in producer surplus.

Regardless of whether there is a decline in producer surplus, the loss in consumer surplus due to monopolistic competition guarantees deadweight loss and an overall loss in economic surplus .

Inefficiency in Monopolistic Competition

Monopolistic competition creates deadweight loss and inefficiency, as represented by the yellow triangle. The quantity is produced when marginal revenue equals marginal cost, or where the green and blue lines intersect. The price is determined based on where the quantity falls on the demand curve, or the red line. In the short run, the monopolistic competition market acts like a monopoly.

Productive and Allocative Efficiency

Productive efficiency occurs when a market is using all of its resources efficiently. This occurs when a product's price is set at its marginal cost, which also equals the product's average total cost. In a monopolistic competitive market, firms always set the price greater than their marginal costs, which means the market can never be productively efficient.

Allocative efficiency occurs when a good is produced at a level that maximizes social welfare. This occurs when a product's price equals its marginal benefits, which is also equal to the product's marginal costs. Again, since a good's price in a monopolistic competitive market always exceeds its marginal cost, the market can never be allocatively efficient.