The Federal Funds rate (or fed funds rate) is the interest rate at which depository institutions (primarily banks) actively trade balances held at the Federal Reserve. In the US, banks are obligated to maintain certain levels of reserves, either in the form of reserves with the Fed or as vault cash. Each day, banks receive deposits, which contribute to a bank's reserves, and issue loans, which are liabilities against the bank. These daily activities change their ratio of reserves to liabilities. If, by the end of the day, the bank's reserve ratio has dropped below the legally required minimum, it must add to its reserves in order to remain compliant with the law. Banks do this by borrowing reserves from other banks with excess reserves, and the weighted average of these interest rates paid by borrowing banks determines the federal funds rate.

The Federal Funds rate is directly related to the interest rate paid by firms and individuals. If a bank can borrow reserves cheaply, it can afford to offer loans to the public at lower rates and still make a profit. On the other hand, if the Federal Funds rate is high, banks will not borrow reserves in order to issue low-interest loans to the public. In fact, many mortgages and credit card interest rates are indexed to the Federal Funds rate - a homeowner might pay an adjustable interest rate that is set at the level of the Federal Funds rate plus four percent, for example. A high Federal Funds rate, therefore, has a contractionary effect on economic activity, while a low Federal Funds rate has an expansionary effect.

The Fed doesn't control the Federal Funds rate directly - it is negotiated between borrowing and lending banks - but it does set a target interest rate and uses open market operations in order to achieve that rate. The target Federal Funds rate is decided by the governors at the Federal Open Market Committee (FOMC) meetings, who will either increase, decrease, or leave the target rate unchanged based on the economic conditions within the country . Influencing the Federal Funds rate is the primary monetary policy tool that the Fed uses to achieve its dual mandate of stable prices and low unemployment.

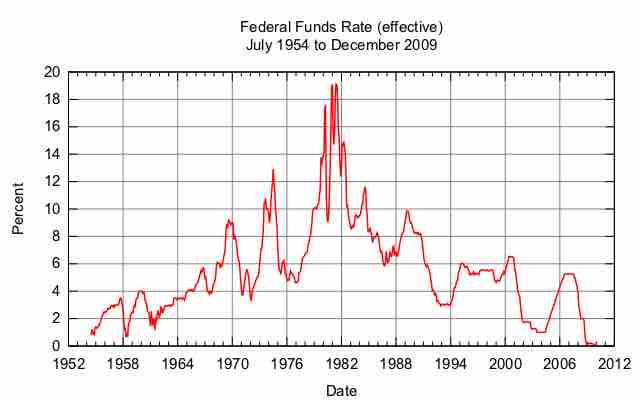

Federal Funds Rate 1954-2009

The graph shows the federal funds rate for the past fifty years. The peak in the 1980s reflects the contractionary monetary policy the Fed instituted to combat high levels of inflation due to oil shocks, and the low rate in the late 2000s reflects expansionary monetary policy meant to combat the effects of recession.