The central bank of the United States is the Federal Reserve (the Fed). The Fed employs monetary policy through direct controls on the money supply through open market operations to achieve economic stability and growth.

Open market operations entail Fed intervention in the buying and selling of government bonds to achieve a change in the money supply and the corresponding change in the interest rate. The Fed sells bonds to reduce the money supply and increase the prevailing interest rate and buys bonds to increase the money supply and reduce the prevailing interest rate. The interest rate is an active target and is set as a target rate range by the Fed; it is conveyed to the public by the Federal Reserve Open Market Committee (FOMC) as the fed funds target rate (short for the Federal Funds rate).

Coincident with the Fed's open market operations is the Fed's selection of a reserve requirement which corresponds to a required percentage of deposits (reserves) that banks must keep on site or at the Fed on a daily basis. Given their daily activities, banks may fall short of their required daily reserve requirement. When this occurs, banks may either turn to the Fed or Fed member banks for overnight or short-term loans to satisfy their liquidity short-fall. The rate that member banks charge each other is referred to as the federal funds rate and the rate the Fed charges banks is referred to as the discount rate.

This distinction is particularly important. The discount rate is the rate that the central bank actual controls. It is the rate the central bank charges its member banks to borrow overnight. However, the rate that the central bank actually cares about is the fed funds rate. That is the rate banks charge each other, and is influenced by the discount rate.

The Fed targets the rate for federal funds via its open market operations and seeks to be the lender of last resort by charging banks a higher rate than the federal funds rate .

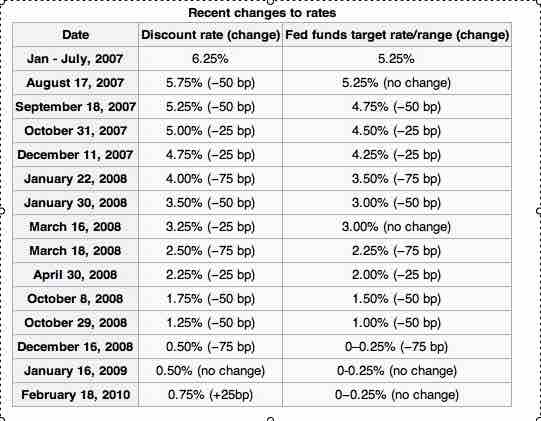

Historical discount and fed fund target rates

The discount rate is higher than the fed funds target rate and the variance serves as a disincentive for banks to seek funds or short-term borrowings from the Fed.

For example, the difference or spread of the primary credit rate (rate to member banks in solid financial standing) over the FOMC's target federal funds rate was initially 1 percent. During the financial crisis, this spread was reduced to one-half of one percent on August 17, 2007, and was further reduced, to a quarter of 1 percent, on March 16, 2008.

Typically, the discount rate along with the fed funds target rate are mechanisms that the Fed uses to discourage banks from excess lending, as part of a contractionary or restrictive policy scheme. Given that lending has an expansionary effect, to the extent that the fed funds target rate and discount rate diminish the profitability of excess loaning, these parameters place limits to the expansion of the money supply via the loanable funds market. However, as noted in the aforementioned historical example, the discount rate, in conjunction with the fed funds target rate, may be purposely maintained at a lower interest level to encourage borrowing and increase growth when the economy is showing signs of either slowing or contracting. In this manner, the discount rate in tandem with the fed funds target rate are part of an expansionary policy mechanism.