In economics, inflation is a persistent increase in the general price level of goods and services in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money; it is a loss of real value, as a single dollar is able to purchase fewer goods than it previously could.

Types of Inflation

The reasons for inflation depend on supply and demand. Depending on the type of inflation, changes in either supply or demand can create an increase in the price level of goods and services. In Keynesian economics, there are three types of inflation.

Demand-Pull Inflation

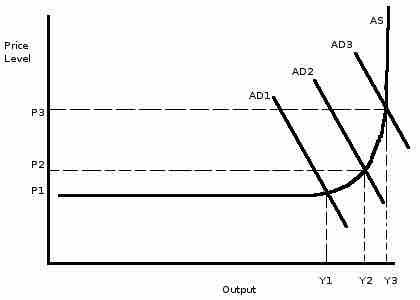

Demand-pull inflation is inflation that occurs when total demand for goods and services exceeds the economy's capacity to produce those goods. Put another way, there is "too much money chasing too few goods. " Typically, demand-pull inflation occurs when unemployment is low or falling. The increases in employment raise aggregate demand, which leads to increased hiring to expand the level of production. Eventually, production cannot keep pace with aggregate demand because of capacity constraints, so prices rise .

Demand-Pull Inflation

Demand-pull inflation is caused by an increase in aggregate demand. As demand increases, so does the price level.

Cost-Push Inflation

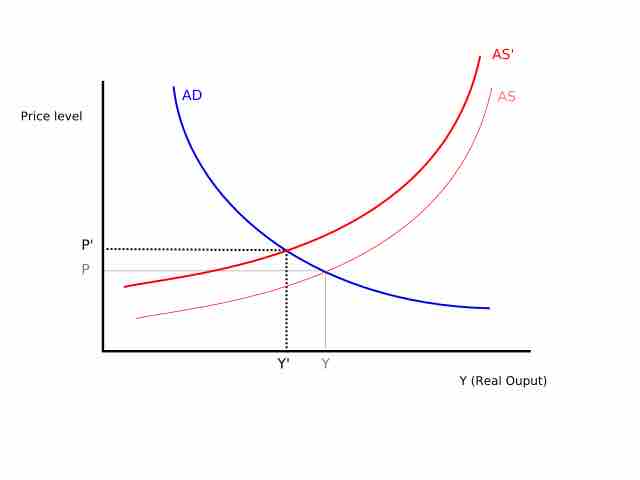

Cost-push inflation occurs when there is an increase in the costs of production. Unlike demand-pull inflation, cost-push inflation is not "too much money chasing too few goods," but rather, a decrease in the supply of goods, which raises prices .

Cost-Push Inflation

As the costs of production inputs rises, aggregate supply can decrease, which increases price levels.

The reason for decreases in supply are usually related to increases in the prices of inputs. One major reason for cost-push inflation are supply shocks. A supply shock is an event that suddenly changes the price of a commodity or service. (sudden supply decrease) will raise prices and shift the aggregate supply curve to the left. One historical example of this is the oil crisis of the 1970's, when the price of oil in the U.S. surged. Because oil is integral to many industries, the price increase led to large increases in the costs of production, which translated to higher price levels.

Built-In Inflation

Built-in inflation is the result of adaptive expectations. If workers expect there to be inflation, they will negotiate for wages increasing at or above the rate of inflation (so as to avoid losing purchasing power). Their employers then pass the higher labor costs on to customers through higher prices, which actually reflects inflation. Thus, there is a cycle of expectations and inflation driving one another.