Consumer Price Index

The consumer price index (CPI) is a statistical estimate of the level of prices of goods and services bought for consumption by households. It measures changes in the price level of a market basket of goods and services used by households. The CPI is calculated by collecting the prices of a sample of representative items over a specific period of time. Goods and services are divided into categories, sub categories, and sub indexes. All of the information is combined to produce the overall index of consumer expenditures. The annual percentage change in a CPI is used to measure inflation. The CPI can be used to index the real value of wages, salaries, pensions, and price regulation. It is one of the most closely watched national economic statistics.

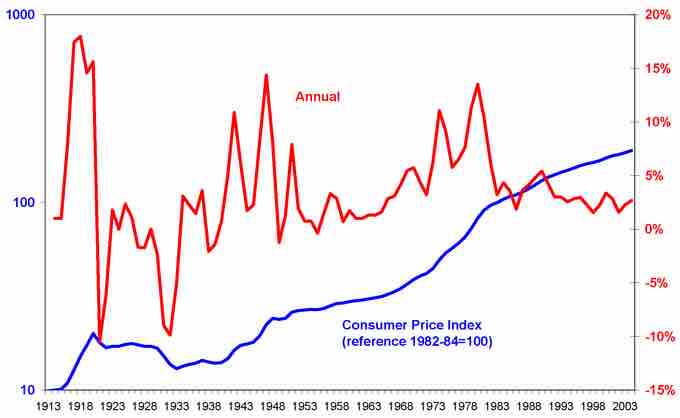

Consumer Price Index

The graph shows the consumer price index in the United States from 1913 - 2004. The x-axis indicates year, the left y-axis indicates the Consumer Price Index, and the right y-axis indicates annual percentage change in Consumer Price Index, which can be used to measure inflation.

Calculating CPI using a Single Item

In order to calculate the CPI using a single item the following equation is used:

Calculating the CPI for Multiple Items

When calculating the CPI for multiple items, it must be noted that many but not all price indices are weighted averages using weights that sum to 1 or 100. When calculating the average for a large number of products, the price is given a weighted average between 1 and 100 to simplify calculation. The weighting determines the importance of the quantity of the product on average. The equation for calculating the CPI for multiple items is:

For example, imagine you buy five sandwiches, two magazines, and two pairs of jeans. In the first period, sandwiches are $6 each, magazines are $4 each, and jeans are $35 each. This will be our base period. In the second period, sandwiches are $7, magazines are $6, and jeans are $45.

Market basket at base period prices = 5(6.00) + 2(4.00) + 2(35.00) = 108.00.

Market basket at current period prices = 5(7.00) + 2(6.00) + 2(45.00) = 137.00.

The CPI based on consumption is 127.

CPI Limitations

The CPI is a convenient way to calculate the cost of living and price level for a certain period of time. However, the CPI does not provide a completely accurate estimate for the cost of living. Issues that impede the accuracy of the CPI include substitution bias (consumers substituting goods for others), introducing new products, and changes in quality. The CPI can also overstate inflation because it does not always account for quality improvements or new goods and services.

GDP Deflator vs. CPI

The GDP deflator is a measure of the level of prices of all new, domestically produced, final goods and services in an economy. Unlike the CPI, the GDP deflator is a measure of price inflation or deflation for a specific base year. The GDP deflator differs from the CPI because it is not based on a fixed basket of goods and services. The GDP deflator "basket" changes from year to year depending on people's consumption and investment patterns. Unlike the CPI, the GDP deflator is not impacted by substitution biases. Despite the GDP being more flexible, the CPI is a more accurate reflection of the changes in the cost of living.