Long run growth is the increase in the market value of the goods and services produced by an economy over time. It is conventionally measured as the percentage of increase in real gross domestic product, or real GDP. Growth is usually calculated in real terms: it is inflation-adjusted to eliminate the distorting effect of inflation on the price of goods produced. In economics, economic growth or economic growth theory typically refers to growth of potential output, which is production at full employment.

Policymakers strive for steady, continued, and consistent growth because it is predictable and manageable for both policymakers and market participants. Over long periods of time even small rates of growth, like a 2% annual increase, have large effects. For example, the United Kingdom experienced a 1.97% average annual increase in its inflation-adjusted GDP between 1830 and 2008. In 1830, the GDP was £41,373 million. It grew to £1,330,088 million by 2008 (in 2005 pounds). A growth rate that averaged 1.97% over 178 years resulted in a 32-fold increase in GDP by 2008 .

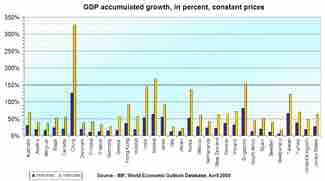

Long-run growth rates

Growth in GDP can be significant, especially when annual growth rates are fairly consistent.

The Power of Compounding

The large impact of a relatively small growth rate over a long period of time is due to the power of compounding. A growth rate of 2.5% per annum leads to a doubling of the GDP within 29 years, while a growth rate of 8% per annum (an average exceeded by China between 2000 and 2010) leads to a doubling of GDP within 10 years. Therefore, a small difference in economic growth rates between countries can result in very different standards of living for their populations if this small difference continues for many years.

Note: an easy way to approximate the doubling time of a number with a constant growth rate is to use the Rule of 72. Divide 72 by the percentage annual growth rate to get a rough estimate of the number of years until the number doubles. For example, at a 10%, divide 72 by 10 to get a doubling time of 7.2 years. The actual doubling time is 7.27 years, so the rule of 72 is a good rough approximation.