Chapter 33

Economic Crises

Book

Version 3

By Boundless

By Boundless

Boundless Economics

Economics

by Boundless

Section 1

Fundamentals of Banking Crises

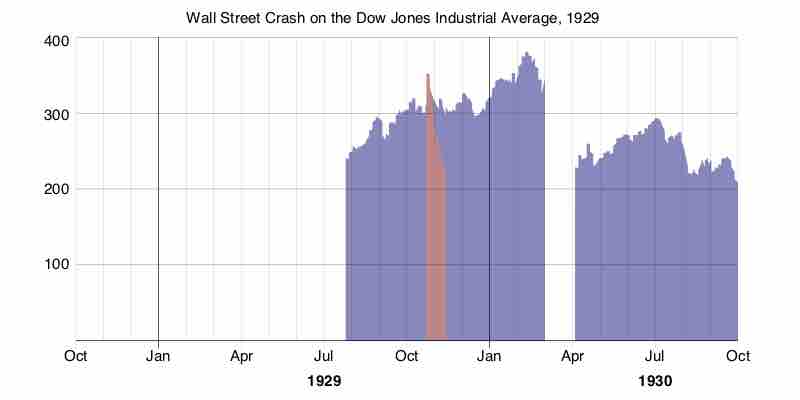

Causes of Banking Crises

Banking crises can be caused by inadequate governmental oversight, bank runs, positive feedback loops in the market and contagion.

Consequences of Banking Crises

Banking crises have a range of short-term and long-term repercussions, domestically and globally, that reduce economic output and growth.

Section 2

The 2007-2009 Crisis

Causes and Immediate Impacts of the Crisis

Banks, consumers, and the government all contributed to improper borrowing and lending, which in turn created a downward spiraling economy.

Recovery

The objective of economic recovery when in crisis is to stabilize the economy and recapture the value lost using economic stimulus strategies.

Global Impacts

The 2007-2009 economic collapse was damaging not only to the U.S. but also global markets, driving the global economy into recession.

You are in this book

Boundless Economics

by Boundless