The Great Recession, The Housing Bubble, the Sub-Prime Crisis, the Depression of 2007-08— the financial crisis in 2008 is known by quite a few names. When considering the causes of the financial disaster, it is important to note that governments, banks, investors, and borrowers made some bad decisions. At the center of these bad decisions was the lending of capital (credit) to individuals who were unlikely to be able to repay it.

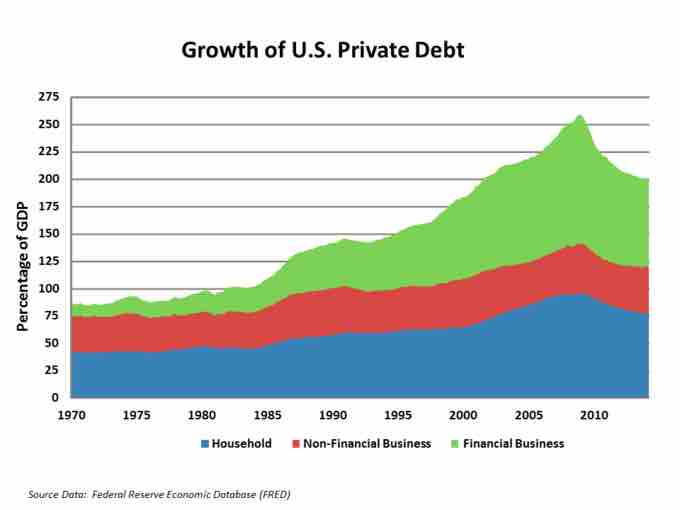

Debt to GDP Ratio

This chart demonstrates the overall percentage of debt owned by governments, companies, and individuals relative to overall GDP. The spike shows how credit before the 2008 disaster was easily obtained (irresponsibly so), and post 2008 the reaction has been a reversal of that trend (albeit, temporarily).

This resulted in what's called a credit crunch. The credit crunch from the 2008 economic disaster was quite significant, and the scale of the financial collapse was enormous.

Credit Crunch Post-2008

Foreclosures

To understand the trends in decreased lending by the banks, it's useful to observe the increases in foreclosures (demonstrated risk) that underline the risk banks are taking in the current economy:

- 2007: 2,203,295 foreclosures were filed on 1,285,873 properties during the year, up 75 percent from 2006.

- 2008: 3,157,806 foreclosures were filed on 2,330,483 properties during the year, up 81 percent from 2007.

- 2009: 3,957,643 foreclosures were filed on 2,824,674 properties during the year, up 21 percent from 2008.

- 2010: 3,825,637 foreclosures were filed on 2,871,891 properties during 2010, up nearly 2 percent from the previous year.

- 2011: 1,887,777 properties received foreclosure notices during the year, down 34 percent from last year.

- 2012: 1,836,634 properties received foreclosure notices during the year, down 3 percent from last year.

- 2013: 1,361,795 properties received foreclosure notices during the year, down 26 percent from last year.

- 2014: 1,117,426 properties received foreclosure notices in 2014, a 18 percent decrease over 2013.

- 2015: 1,083,572 properties received foreclosure notices in 2015, a 3 percent decrease over 2014.

Lending

With the above foreclosures in mind, banks were not particularly eager to repeat their past mistakes by offering credit to anyone (and bundling these mortgages into derivatives supposedly labeled as low risk AAA securities, a highly misleading practice that contributed substantially to the problem). As a result, lending became more stringent in terms of proof of income and the required down payments.

Prior to the turn of the 21st century, it was common practice to provide 20% down payment on a loan, alongside providing proof of income (in the United States, that is). Indeed, most developing countries require these types of proofs for a sizable loan such as a mortgage. These rules were removed in the United States, leading the 21st century into a massive increase in homeowner borrowing. Addressing this was a primary concern after the 2008 collapse, building in safety measures to mitigate risk in borrowing for home purchasing.

That being said, spending is good for the economy, so interest rates became quite low post 2008. This is somewhat unusual for a credit crunch, as low interest rates stimulate borrowing. However, creating spend is one tactic for reversing an economic recession, and this is exactly what was done.

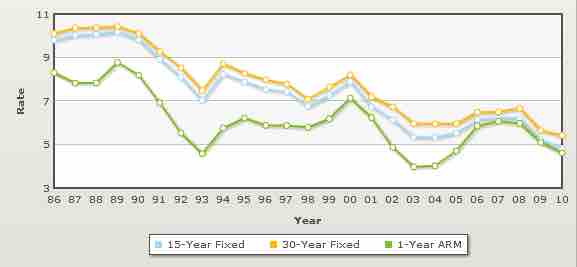

Mortgage Rates (US)

This chart shows the rates of interest incurred by borrowers over time in the US mortgage market, most notably highlighting the relative decrease in overall interest rates even after the Great Recession.