Why Liquidity Matters

To accurately frame the discussion of cash flows, an understanding of liquidity is integral. Having cash on hand is a seemingly simple concept. If I have capital, I can spend it. For businesses, however, it is quite a bit more complex. Cash flows must take into account not only amounts of capital, but the time value and availability of said capital.

When an organization has an opportunity to fund, or a debt to pay, they need capital on hand (i.e. capital available now) to provide funding. While an organization may have a great deal of value, this does not mean that said value equates to usable capital.

Let's take an example. Company A and Company C want to purchase a new manufacturing machine from Company B. However, Company B will sell at their determined price to the first company with the capital to pay. Capital A has the majority of their money wrapped up in inventory (i.e. holding products for sale) which they expect to sell within 4 weeks, while Company C has their capital in a savings account. Company C will capture the opportunity, as the capital they are using is more liquid.

Liquidity

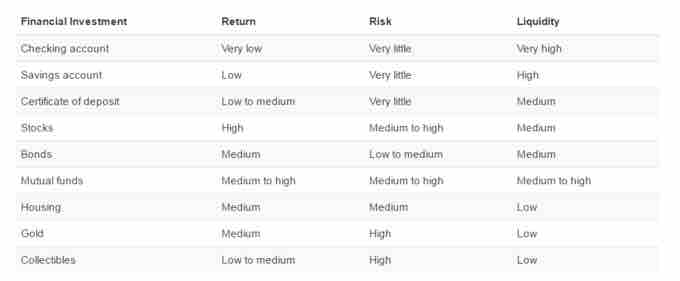

This chart shows some estimations of various types of capital investments, alongside their respective risk, return, and liquidity.

Liquidity Risk

When considering cash flow, it is important to understand liquidity risk. The difficulty in taking a certain asset to market, and recovering capital without incurring a loss of value, is called liquidity risk. When looking at overall cash flow, it's important to consider how easily the available assets and investments are converted into capital to capture external opportunities.

All investments of capital can be framed with three key attributes: average expected return, degree of risk, and overall liquidity. Business managers and accountants, when considering their investment options, should keep liquidity in mind at all times. Conversely, having cash sitting without investment also incurs an opportunity cost. Inflation generally devalues any cash asset, and investing capital into money markets can generate interest. The decision of how much cash to invest, and where to invest it, is therefore a key consideration when balancing accounts for an organization.