Section 4

Reporting and Analyzing Long-Term Liabilities

Book

Version 3

By Boundless

By Boundless

Boundless Accounting

Accounting

by Boundless

5 concepts

Reporting Long-Term Liabilities

Debts that become due more than one year into the future are reported as long-term liabilities on the balance sheet.

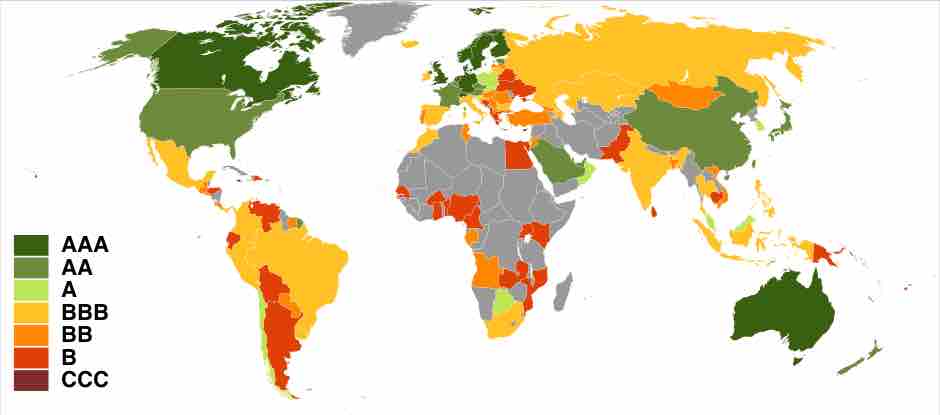

Analyzing Long-Term Liabilities

Analyzing long-term liabilities combines debt ratio analysis, credit analysis and market analysis to assess a company's financial strength.

Debt-to-Equity Ratio

The Debt-to-Equity Ratio is a financial ratio that compares the debt of a company to its equity and is closely related to leveraging.

Times Interest Earned Ratio

Times Interest Earned Ratio = (EBIT or EBITDA) / (Required Interest Payments), and is indicative of a company's financial strength.

Being Aware of Off-Balance-Sheet Financing

Off-Balance-Sheet-Financing represents rights to use assets or obligations that are not reported on balance sheets to pay liabilities.