Overview Of Bonds

Bonds are debt instruments issued by bond issuers to bond holders. A bond is a debt security under which the bond issuer owes the bond holder a debt including interest or coupon payments and or a future repayment of the principal on the maturity date. Variations exist in bond types, payment terms, and features.

Interest on bonds, or coupon payments, are normally payable in fixed intervals, such as semiannually, annually, or monthly. Ownership of bonds are often negotiable and transferable to secondary markets. Bonds provide the borrower with external funds to finance long-term investments, or, in the case of government bonds, to finance current expenditure .

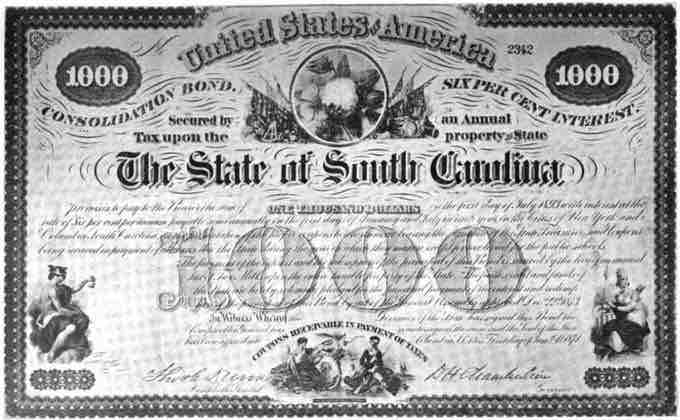

Government Bond

This is an image of a state-issued debt instrument including all the essential information for the indenture.

Bonds and stocks are both securities, but the major difference between the two is that stockholders have an equity stake in the company, whereas bondholders have a creditor stake in the company. Another difference is that bonds usually have a defined term, or maturity, after which the bond is redeemed, whereas stocks may be outstanding indefinitely. An exception is an irredeemable bond, such as a perpetuity.

Principal

Nominal, principal, par, or face amount—the amount on which the issuer pays interest, and which, most commonly, has to be repaid at the end of the term.

Maturity

The issuer has to repay the nominal amount on the maturity date. As long as all due payments have been made, the issuer has no further obligations to the bond holders after the maturity date. The length of time until the maturity date is often referred to as the term or maturity of a bond. In the market for United States Treasury securities, there are three categories of bond maturities:

- short term (bills): maturities between one to five year (instruments with maturities less than one year are called money market instruments)

- medium term (notes): maturities between six to twelve years

- long term (bonds): maturities greater than twelve years

Coupon

The coupon is the interest rate that the issuer pays to the bond holders. Usually this rate is fixed throughout the life of the bond. It can also vary with a money market index, such as LIBOR, or it can be even more exotic.

Yield

The yield is the rate of return received from investing in the bond. It usually refers either to the current yield, or running yield, which is simply the annual interest payment divided by the current market price of the bond. It can also refer to the yield to maturity or redemption yield, which is a more useful measure of the return of the bond, taking into account the current market price, and the amount and timing of all remaining coupon payments and of the repayment due on maturity. It is equivalent to the internal rate of return of a bond.

Credit Quality

The "quality" of the issue refers to the probability that the bondholders will receive the amounts promised on the due dates. This will depend on a wide range of factors. High-yield bonds are bonds that are rated below investment grade by the credit rating agencies. As these bonds are more risky than investment-grade bonds, investors expect to earn a higher yield. Therefore, because of the inherent riskiness of these bonds, they are also called high-yield or "junk" bonds.

Market Price

The market price of a tradeable bond will be influenced among other things by the amounts, currency, the timing of the interest payments and capital repayment due, the quality of the bond, and the available redemption yield of other comparable bonds which can be traded in the markets.

The issue price at which investors buy the bonds when they are first issued will typically be approximately equal to the nominal amount. The net proceeds that the issuer receives are thus the issue price less issuance fees.

Optionality

Occasionally a bond may contain an embedded option:

Callability — Some bonds give the issuer the right to repay the bond before the maturity date on the call dates. Most callable bonds allow the issuer to repay the bond at par. With some bonds, the issuer has to pay a premium. This is mainly the case for high-yield bonds. These have very strict covenants, restricting the issuer in its operations. To be free from these covenants, the issuer can repay the bonds early, but only at a high cost.

Putability — Some bonds give the holder the right to force the issuer to repay the bond before the maturity date on the put dates. These are referred to as retractable or putable bonds.