Section 1

The Income Statement

Book

Version 3

By Boundless

By Boundless

Boundless Accounting

Accounting

by Boundless

6 concepts

Defining the Income Statement

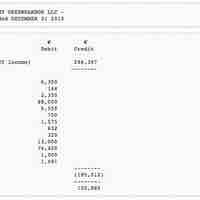

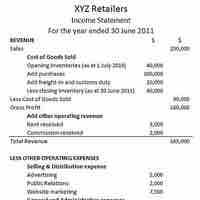

Income statement is a company's financial statement that indicates how the revenue is transformed into the net income.

Elements of the Income Statement

The income statement, or profit and loss statement (P&L), reports a company's revenue, expenses, and net income over a period of time.

Noncash Items

Noncash items, such as depreciation and amortization, will affect differences between the income statement and cash flow statement.

Uses of the Income Statement

The primary purpose of the income statement is to assess efficiency as revenues transform into profits/losses.

Limitations of the Income Statement

Income statements have several limitations stemming from estimation difficulties, reporting error, and fraud.

Effects of GAAP on the Income Statement

GAAP's assumptions, principles, and constraints can affect income statements through temporary (timing) and permanent differences.