Notes Receivable

Notes Receivable represents claims for which formal instruments of credit are issued as evidence of debt, such as a promissory note. The credit instrument normally requires the debtor to pay interest and extends for time periods of 30 days or longer. Notes receivable are considered current assets if they are to be paid within 1 year and non-current if they are expected to be paid after one year.

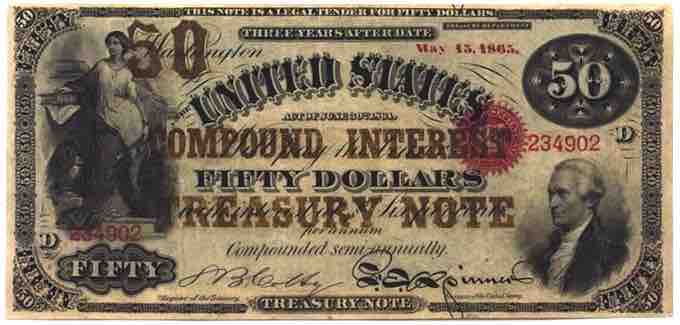

Compound Interest Treasury Note

Notes are short-term investment vehicles.

Reporting of Cash and Receivables

Accrued revenue (or accrued assets) is an asset such as proceeds from a delivery of goods or services, at which such income item is earned and the related revenue item is recognized, while cash for them is to be received in a latter accounting period. At that point its amount is deducted from accrued revenues.

Valuing Notes/Accounts Receivable

Companies have two methods available to them for measuring the net value of accounts receivable--the allowance method and the direct write-off method.

The Allowance Method

The first method is the allowance method, which establishes a contra-asset account, allowance for doubtful accounts, or bad debt provision, that has the effect of reducing the balance for accounts receivable. The amount of the bad debt provision can be computed in two ways:

- by reviewing each individual debt and deciding whether it is doubtful (a specific provision)

- by providing for a fixed percentage (e.g. 2%) of total debtors (a general provision)

The Direct Write Off Method

The second method is the direct write off method. It is simpler than the allowance method in that it allows for one simple entry to reduce accounts receivable to its net realizable value. The entry would consist of debiting a bad debt expense account and crediting the respective accounts receivable in the sales ledger.