In accounting, notes receivables are accounts to keep track of accrued assets that have been earned but not yet received.

Accrued Assets

Accrued assets are assets, such as interest receivable or accounts receivable, that have not been recorded by the end of an accounting period. These assets represent rights to receive future payments that are not due at the balance sheet date. To present an accurate picture of the affairs of the business on the balance sheet, firms recognize these rights at the end of an accounting period by preparing an adjusting entry to correct the account balances. To indicate the dual nature of these adjustments, they record a related revenue in addition to the asset. We also call these adjustments 'accrued revenues' because the revenues must be recorded.

Recognizing and Reporting Notes Receivable

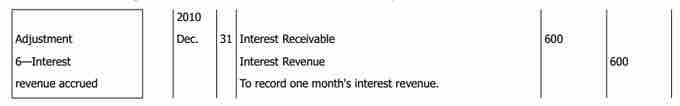

To record a journal entry for a sale on account, one must debit a receivable and credit a revenue account. When the customer pays off their accounts, one debits cash and credits the receivable in the journal entry. For example, a sale on account would be recorded similarly to the following interest receivable journal entry:

Notes Receivable Example

Recording an interest receivable journal entry

The ending balance on the trial balance sheet for accounts receivable is usually a debit. Business organizations which have become too large to perform such tasks by hand (or small ones that could but prefer not to) will generally use accounting software on a computer to perform this task. Companies have two methods available to them for measuring the net value of accounts receivable, which is generally computed by subtracting the balance of an allowance account from the accounts receivable account.

Allowance method

The first method is the allowance method, which establishes a contra-asset account, allowance for doubtful accounts, or bad debt provision, that has the effect of reducing the balance for accounts receivable.

The amount of the bad debt provision can be computed in two ways, either (1) by reviewing each individual debt and deciding whether it is doubtful (a specific provision); or (2) by providing for a fixed percentage (e.g. 2%) of total debtors (a general provision). The change in the bad debt provision from year to year is posted to the bad debt expense account in the income statement.

Direct write-off method

This second method is simpler than the allowance method in that it allows for one simple entry to reduce accounts receivable to its net realizable value. The entry would consist of debiting a bad debt expense account and crediting the respective accounts receivable in the sales ledger.

The two methods are not mutually exclusive, and some businesses will have a provision for doubtful debts, writing off specific debts that they know to be bad (for example, if the debtor has gone into liquidation. )