The Trial Balance

During the accounting cycle, a trial balance is prepared. It is usually prepared after all the journal entries for the period have been recorded.

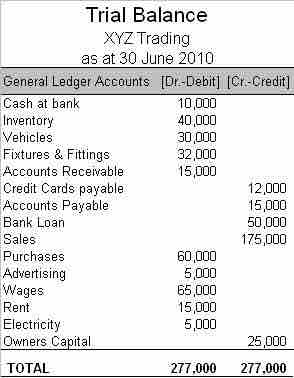

The trial balance tests the equality of a company's debits and credits. It lists all of the ledger, both general journal and special, accounts and their debit or credit balances to determine that debits equal credits in the recording process .

The Trial Balance

The post-closing trial balance proves debits still equal credits after the closing entries have been made.

The accounts appear in this order: assets, liabilities, stockholders' equity, dividends, revenues, and expenses. Within the assets category, the most liquid (closest to becoming cash) asset appears first and the least liquid appears last. Within the liabilities, those liabilities with the shortest maturities appear first.

If the total of the debit column does not equal the total value of the credit column then this would show that there is an error in the nominal ledger accounts. This error must be found before a profit and loss statement and balance sheet can be produced.

Preparing the Trial Balance

The trial balance is usually prepared by a bookkeeper or accountant. The bookkeeper/accountant used journals to record business transactions. The journal entries were then posted to the general ledger. The trial balance is a part of the double-entry bookkeeping system and uses the classic 'T' account format for presenting values. A trial balance only checks the sum of debits against the sum of credits. If debits do not equal credits then the accountant or bookkeeper must determine why.

In the example of Highland Yoga, the pre-opening trial balance would be calculated as follows:

1. You contribute $4,000 in cash to start the business.

Cash 4,000, Contributed Capital 4,000; Assets(+)=Equity(+)

2. You purchase $500 worth of mats and other equipment for use during classes.

Cash -500, PPE 500; Assets(+), Assets(-)=0

3. You purchase an additional $400 worth of mats, equipment, and clothing for sale at the studio.

Cash -400, Inventory 400; Assets(+), Assets(-)=0

4. You purchase liability insurance at a total cost of $1,200. The policy covers July 1 through December 31.

Cash -1,200, Prepaid Insurance 1,200; Assets(+), Assets(-)

The trial balance for debits will be:

4,000 (cash) + 500 (PPE) + 400 (inventory) + 1,200 (prepaid insurance) = 6,100

The trial balance for credits will be:

4,000 (contributed capital) + 500 (cash) + 400 (cash) + 1,200 (cash) = 6,100

The calculation will be the same for the next two periods in the example, including any necessary adjustments.

Finding Errors in the Trial Balance

Some reasons why the general ledger may be out of balance:

- Failing to post part of a journal entry.

- Posting a debit as a credit, or vice versa.

- Incorrectly determining the balance of an account.

- Recording the balance of an account incorrectly in the trial balance.

- Omitting an account from the trial balance.

- Making a transposition or slide error in the accounts or the journal.

When the error is found, a correcting entry must be made. Then another trial balance is run.