Definition

Section 179 of the United States Internal Revenue Code (26 U.S.C. § 179) allows a taxpayer to elect to deduct the cost of certain types of property on their income taxes as an expense, rather than requiring the cost of the property to be capitalized and depreciated. This property is generally limited to tangible, depreciable, personal property which is acquired by purchase for use in the active conduct of a trade or business . This can afford considerable tax savings in some circumstances.

Property

Buildings were not eligible for section 179 deductions prior to the passage of the Small Business Jobs Act of 2010; however, qualified real property may now be deducted. Depreciable property that is not eligible for a section 179 deduction is still deductible over a number of years through MACRS depreciation according to sections 167 and 168. The 179 election is optional, and the eligible property may be depreciated according to sections 167 and 168 if preferable for tax reasons. Furthermore, the 179 election may be made only for the year the equipment is placed in use and is waived if not taken for that year. However, if the election is made, it is irrevocable unless special permission is given.

Limitations

The § 179 election is subject to three important limitations:

- There is a dollar limitation. Under section 179(b)(1), the maximum deduction a taxpayer may elect to take in a year is 500,000 dollars in 2010 and 2011, 125,000 dollars in 2012, and 25,000 dollars for years beginning after 2012.

- If a taxpayer places more than 2 million dollars worth of section 179 property into service during a single taxable year, the 179 deduction is reduced, dollar for dollar, by the amount exceeding the 2 million threshold. This threshold is further reduced to 500,000 dollars beginning in 2012, and then 200,000 dollars afterward.

- Lastly, the section provides that a taxpayer's 179 deduction for any taxable year may not exceed the taxpayer's aggregate income from the active conduct of trade or business by the taxpayer for that year. If, for example, the taxpayer's net trade or business income from active conduct of trade or business was 72,500 dollars in 2006, then the deduction cannot exceed 72,500 dollars that year. However, any deduction not allowed in a given year under this limitation can be carried over to the next year.

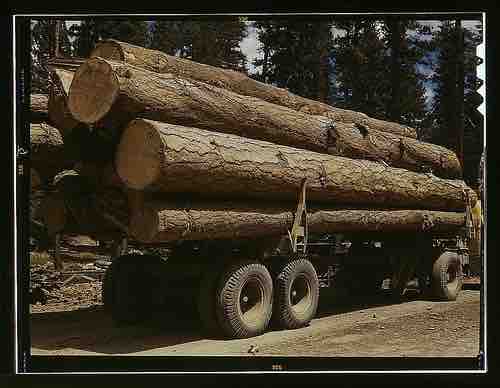

Truck

Expensing is applied to property used in a business, such as trucks.