Section 1

Introduction to Taxes

Book

Version 3

By Boundless

By Boundless

Boundless Economics

Economics

by Boundless

2 concepts

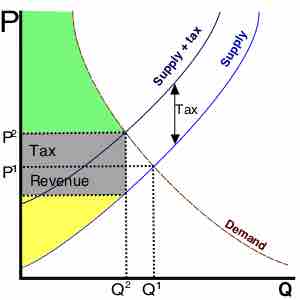

What Taxes Do

On a general level, tax collections provide a revenue source to support the outlays or primary activities of a government.

How Taxes Impact Efficiency: Deadweight Losses

In economics, deadweight loss is a loss of economic efficiency that can occur when equilibrium for a good or service is not Pareto optimal.