Background

In the rise of monetarism as an ideology, two specific economists were critical contributors. Clark Warburton, in 1945, has been identified as the first thinker to draft an empirically sound argument in favor of monetarism. This was taken more mainstream by Milton Friedman in 1956 in a restatement of the quantity theory of money. The basic premise these two economists were putting forward is that the supply of money and the role of central banking play a critical role in macroeconomics.

The generation of this theory takes into account a combination of Keynesian monetary perspectives and Friedman's pursuit of price stability. Keynes postulated a demand-driven model for currency; a perspective on printed money that was not beholden to the 'gold standard' (or basing economic value off of rare metal). Instead, the amount of money in a given environment should be determined by monetary rules. Friedman originally put forward the idea of a 'k-percent rule,' which weighed a variety of economic indicators to determine the appropriate money supply.

Evidence

Theoretically, the idea is actually quite straight-forward. When the money supply is expanded, individuals will be induced to higher spending. In turn, when the money supply retracted, individuals would limit their budgetary spending accordingly. This would theoretically provide some control over aggregate demand (which is one of the primary areas of disagreement between Keynesian and classical economists).

Monetarism began to deviate more from Keynesian economics however in the 70's and 80's, as active implementation and historical reflection began to generate more evidence for the monetarist view. In 1979 for example, Jimmy Carter appointed Paul Volcker as Chief of the Federal Reserve, who in turn utilized the monetarist perspective to control inflation. He eventually created a price stability, providing evidence that the theory was sound. In addition, Milton Friedman and Ann Schwartz analyzed the Great Depression in the context of monetarism as well, identifying a shortage of the money supply as a critical component of the recession.

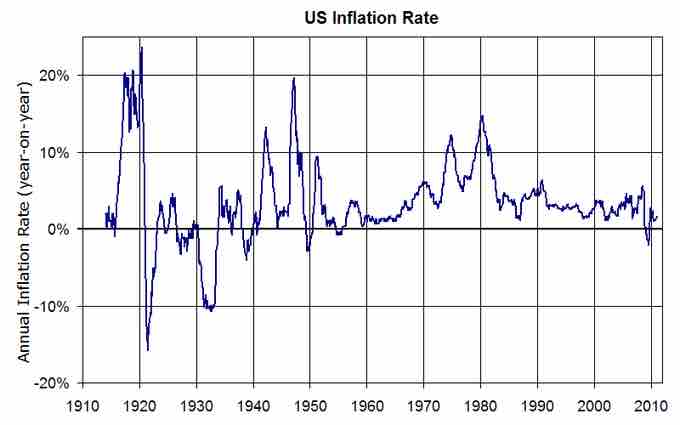

The 1980s were an interesting transitional period for this perspective, as early in the decade (1980-1983) monetary policies controlling capital were attributed to substantial reductions in inflation (14% to 3%)(see ). However, unemployment and the rise of the use of credit are quoted as two alternatives to money supply control being the primary influence of the boom that followed 1983.

U.S. Inflation Rates

The inflation rates over time in the U.S. represent some of the evidence put forward by monetarist economists, stating that governmental control of the money supply allows for some control over inflation.

Counter Arguments

As these counter arguments in the 1980s began to arise, critics of monetarism became more mainstream. Of the current monetarism critics, the Austrian school of thought is likely the most well-known. The Austrian school of economic thought perceives monetarism as somewhat narrow-minded, not effectively taking into account the subjectivity involved in valuing capital. That is to say that monetarism seems to assume an objective value of capital in an economy, and the subsequent implications on the supply and demand.

Other criticisms revolve around international investment, trade liberalization, and central bank policy. This can be summarized as the effects of globalization, and the interdependence of markets (and consequently currencies). To manipulate money supply there will inherently be effects on other currencies as a result of relativity. This is particularly important in regards to the U.S. currency, which is considered a standard in international markets. Controlling supply and altering value may have effects on a variety of internal economic variables, but it will also have unintended consequences on external variables.