Section 5

The Federal Reserve System

By Boundless

The Federal Reserve System is the central banking system of the United States, which conducts the nation's monetary policy.

One of the Federal Reserve's duties is to regulate financial institutions, such as bank-holding companies and state member banks.

The U.S. Federal Reserve as the "lender of last resort" extends credit to financial institutions unable to obtain credit elsewhere.

The Fed created a nationwide check-clearing system that provided an efficient and stable way of transferring funds between institutions.

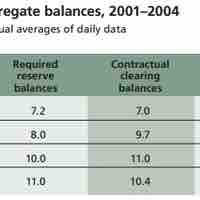

The Federal Reserve is in charge of setting reserve requirements for all depository institutions in the country.

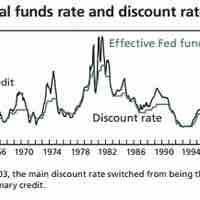

The Fed makes loans to depository institutions and charges different discount rates for each of discount windows.

Open market operations (OMO) refer to a central bank's selling or buying of government bonds on the open market.