Bonds can be redeemed at or before maturity. Early redemption may happen on bond issuers or bondholders' intentions .

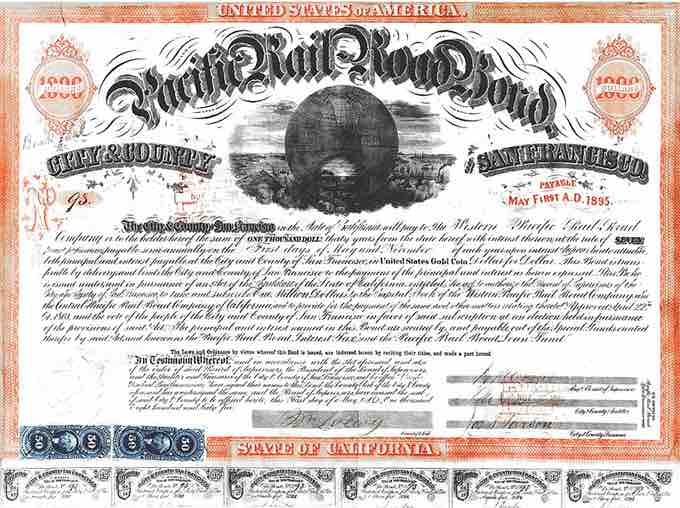

Pacific Railroad Bond

$1,000 (30 year, 7%) "Pacific Railroad Bond" (#93 of 200) issued by the City and County of San Francisco.

For bond issuers, they can repurchase a bond at or before maturity. Redemption is made at the face value of the bond unless it occurs before maturity, in which case the bond is bought back at a premium to compensate for lost interest. The issuer has the right to redeem the bond at any time, although the earlier the redemption takes place, the higher the premium usually is. This provides an incentive for companies to do this as rarely as possible. It is notable that early repurchase happens more often when the interest rate in the market is on decline and when the bond contains an embedded option. It grants option-like features to the holder or the issuer. To be detailed, the bond issuer will repurchase bonds with callability.

Some bonds give the issuer the right to repay the bond before the maturity date on the call dates. These bonds are referred to as callable bonds. Most callable bonds allow the issuer to repay the bond at par. With some bonds, the issuer has to pay a premium, the so-called call premium. This is mainly the case for high-yield bonds. These have very strict covenants. They restrict the issuer in its operations. To be free from these covenants, the issuer can repay the bonds early, but only at a high cost.

Bonds with embedded options can also be ones with putability. Some bonds give the holder the right to force the issuer to repay the bond before the maturity date on the put dates. These are referred to as retractable or putable bonds. In this case, the price at which bonds are redeemed is predetermined in bond covenants.