Section 10

The DuPont Equation, ROE, ROA, and Growth

Book

Version 3

By Boundless

By Boundless

Boundless Accounting

Accounting

by Boundless

5 concepts

Assessing Internal Growth and Sustainability

Sustainable-- as opposed to internal-- growth gives a company a better idea of its growth rate while keeping in line with financial policy.

Dividend Payments and Earnings Retention

The dividend payout and retention ratios offer insight into how much of a firm's profit is distributed to shareholders versus retained.

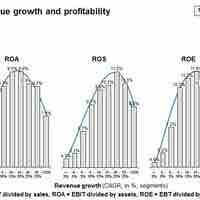

Relationships between ROA, ROE, and Growth

Return on assets is a component of return on equity, both of which can be used to calculate a company's rate of growth.

The DuPont Equation

The DuPont equation is an expression which breaks return on equity down into three parts: profit margin, asset turnover, and leverage.

ROE and Potential Limitations

Return on equity measures the rate of return on the ownership interest of a business and is irrelevant if earnings are not reinvested or distributed.