The Federal Tax System

The United States is a federal republic with autonomous state and local governments. Taxes are imposed at each of these levels. These include taxes on income, payroll, property, sales, imports, estates and gifts, as well as various fees. The taxes collected in 2010 by federal, state and municipal governments amounted to 24.8% of the GDP.

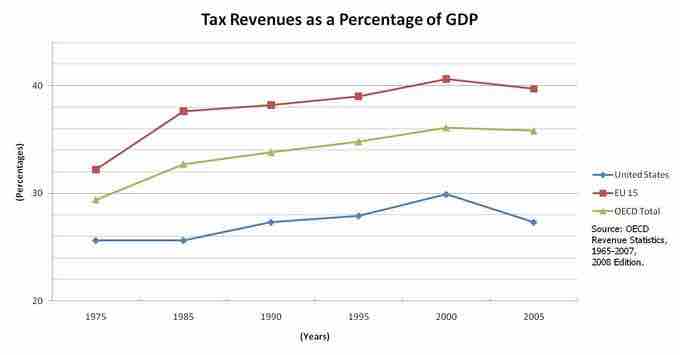

U.S. Tax Revenues

U.S. Tax Revenues as a Percentage of GDP

Taxes are imposed on net income of individuals and corporations by the federal, most state, and some local governments. Citizens and residents are taxed on worldwide income and allowed a credit for foreign taxes. Income subject to tax is determined under tax rules, not accounting principles, and includes almost all income. Most business expenses reduce taxable income, though limits apply to a few expenses. Individuals are permitted to reduce taxable income by personal allowances and certain non-business expenses that can include home mortgage interest, state and local taxes, charitable contributions, medical, and certain other expenses incurred above certain percentages of income. State rules for determining taxable income often differ from federal rules. Federal tax rates vary from 10% to 35% of taxable income. State and local tax rates vary widely by jurisdiction, from 0% to 12.696% and many are graduated. State taxes are generally treated as a deductible expense for federal tax computation. Certain alternative taxes may apply. The United States is the only country in the world that taxes its nonresident citizens on worldwide income or estate, in the same manner and rates as residents.

Payroll taxes are imposed by the federal and all state governments. These include Social Security and Medicare taxes imposed on both employers and employees, at a combined rate of 15.3% (13.3% for 2011). Social Security tax applies only to the first $106,800 of wages in 2009 through 2011. Employers also must withhold income taxes on wages. An unemployment tax and certain other levies apply.

Property taxes are imposed by most local governments and many special purpose authorities based on the fair market value of property. School and other authorities are often separately governed, and impose separate taxes. Property tax is generally imposed only on realty, though some jurisdictions tax some forms of business property. Property tax rules and rates vary widely.

Sales taxes are imposed on the retail price of many goods and some services by most states and some localities. Sales tax rates vary widely among jurisdictions, from 0% to 16%, and may vary within a jurisdiction based on the particular goods or services taxed. Sales tax is collected by the seller at the time of sale, or remitted as use tax by buyers of taxable items who did not pay sales tax.

The United States imposes tariffs or customs duties on the import of many types of goods from many jurisdictions. This tax must be paid before the goods can be legally imported. Rates of duty vary from 0% to more than 20%, based on the particular goods and country of origin.

Estate and gift taxes are imposed by the federal and some state governments on property passed by inheritance or donation. Similar to federal income taxes, federal estate and gift taxes are imposed on worldwide property of citizens and residents and allow a credit for foreign taxes.