Concept

Version 13

Created by Boundless

Determine a Course

Prospect theory and risk aversion

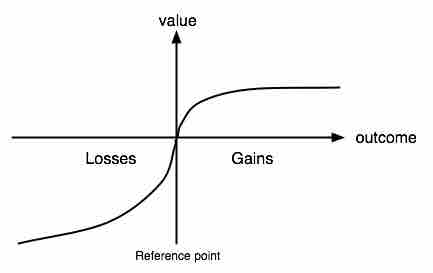

This graph represents Kahneman and Tversky's theory. The distance between the x-axis and the curve is smaller in the positive direction (i.e., for positive outcomes, or gains) than it is in the negative direction (i.e., for negative outcomes, or losses). This means that people's positive value of gains is less than people's negative value of losses. In other words, people are more sensitive to possible risk than to possible gain.

Source

Boundless vets and curates high-quality, openly licensed content from around the Internet. This particular resource used the following sources: