Scenario Analysis

Scenario analysis is a strategic process of analyzing decisions by considering alternative possible outcomes (sometimes called "alternative worlds"). It is not a predictive mechanism, but rather an analytic tool to manage uncertainty today. .

Scenario Analysis

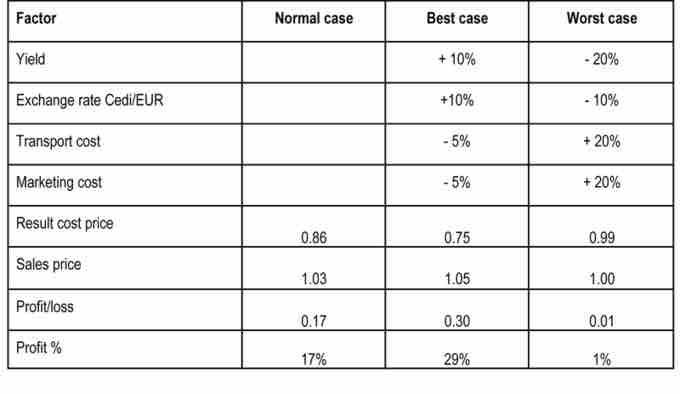

This scenario analysis shows how changes in factors like yield and transport cost can affect profits.

For example, a firm might use scenario analysis to determine the net present value (NPV) of a potential investment under high and low inflation scenarios.

In another example, a bank might attempt to forecast several possible scenarios for the economy (e.g. rapid vs. moderate vs. slow growth) or it might try to forecast financial market returns (for bonds, stocks and cash) in each of those scenarios. Perhaps, it might also consider sub-sets of each of the possibilities. It might further seek to determine correlations and assign probabilities to the scenarios (and sub-sets if any). By analyzing these various scenarios, the bank will be in a better position to consider how best to allocate its assets.

Many scenario analyses use three different scenarios: base case, worst case and best case. The base case is the expected scenario: if all things proceed normally, this is what the expected outcome will be. The worst and best cases are obviously scenarios with less and more favorable conditions, but they are still confined by a sense of feasibility. For example, an investor creating the worst case scenario would not be well served to have it include a meteor strike that destroys the company. While clearly a bad scenario, it is not realistic enough to be helpful.

The purpose of scenario analysis is not to identify the exact conditions of each scenario; it just needs to approximate them to provide a plausible idea of what might happen.