An initial public offering (IPO), also known as a stock market launch, is the first time a private company's shares are sold to the general public on a securities exchange. Allowing the general public to take up equity stakes in the company transforms it from being privately traded to publicly traded. If the company was venture-backed, the VC firms often gain their returns from IPO yields. Usually, the VC exits investments within a short time (1-3 years, normally) after the IPO is concluded either by distributing the shares to VC fund investors or selling them off on the market. Going public can also have benefits for the company, including:

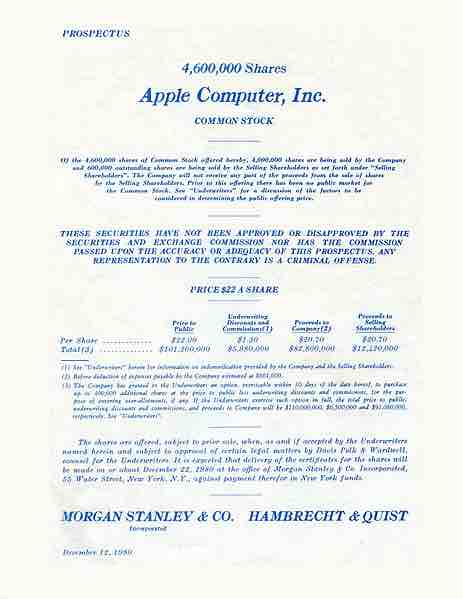

Apple Computers IPO Prospectus

The Initial Public Offering (IPO) Prospectus for Apple Computer Inc. in December 1980. A total of 5 million shares were offered to the public for $22 each. The total outstanding shares after the offering were 54,215,332. The company's officers, directors and major shareholders held 32 million shares and the rest were held by the company for stock options plans and other needs. Apple's valuation after the IPO was over $1 billion. (54 million shares at $22. )

- Increasing exposure, prestige, and public image

- Enlarging and diversifying equity base

- Enabling cheaper access to capital, which is particularly important for high growth companies

- Allowing owners of the company to cash in on their efforts in a very lucrative way (if the IPO is successful).

- Attracting and retaining better management and employees through liquid equity participation

IPOs are not without cost to the company. Disadvantages to completing an initial public offering, include:

- Legal, accounting and marketing costs associated with the process

- Requirement to disclose financial and business information

- Meaningful time, effort and attention required of senior management

- Risk that required funding will not be raised

- Public dissemination of information which may be useful to competitors, suppliers and customers.

Prior to agreeing to provide capital, venture capitalists contract for privileges including "registration rights", which ensure their ability to sell shares into the public capital markets, thereby safeguarding their future returns. Prior to selling shares on the stock exchange, companies must register these shares with the Securities and Exchange Commission. The registration rights agreement between the company and the venture capitalists requires the company to register the offering of shares by venture capitalists under certain conditions.

These conditions may be in the form of "demand rights" or "piggyback rights".

- Demand rights require the company itself to prepare, file and maintain a registration statement on behalf of the investors' shares, so that investors can actually initiate a public offering and sell their shares.

- Piggyback rights require that the VC investors' shareholdings are included in a company-initiated registration, so that the investors can sell their shares when the company initiates a public offering. The number of each type of demand or piggyback rights, the percentage of investors necessary to exercise these rights, allocation of expenses of registration, the minimum size of the offering, the scope of indemnification and the selection of underwriters and brokers are all areas of potential negotiation in the registration rights agreement.