The Purpose of Forecasting

Financial planning is a critical financial tool for funding profitable operations and dividing existing organizational assets optimally to pursue revenue maximization. The forecast budget will project what cash flows will be needed for each organizational process, and how those cash flows will be utilized over a fixed period of time. If there is a problem with liquidity during an operational period, it can result in huge opportunity costs (i.e. an organization being unable to capture an existing opportunity in the market).

How to Forecast

There are a number of ways to approach financial forecasting for a cash budget. A cash budget is all about liquidity, and therefore forecasting what available liquidity will be required over a given period is the primary input for forecasting budgets. There are a number of different approaches, though most of them rely on understanding the inputs required for various business operations.

The inputs include the following cash obligations during regular operations:

It's also worth noting that various cash inflows will occur during a given time period. For example, accounts receivable, short-term financing options, and various other sources of income may directly convert into usable capital. However, budgeting should either build these into the current budget forecast or utilize them during the next calculation of budgetary requirements.

The Direct Method

At its simplest, cash flow forecasting and budgeting can be computed directly based off of fixed information over a short time frame. This works particularly well for consistent businesses that run routine operations with limited risk-taking and diversification in process.

The Adjusted Net Income Method (ANI)

The adjusted net income method starts by calculating operating income (EBIT or EBITDA) and adding/subtracting short-term changes in the balance sheet, such as those that occur to inventories, payable, receivables and other short-term. This gives the organization some idea of what short-term cash flows are typically required during an operational period.

Pro-forma Balance Sheet

Pro-formas are financial statements created in advance as a projection or estimation of what that document will look like after the financial period is finished. By using a pro-forma balance sheet for the upcoming period being budgeted for, the short-term assets and liabilities (if accurately projected) will underline the amount of cash that should be set aside for budgeting purposes.

Accrual Reversal Method

A third option for projecting cash budgets is accrual reversal. This process relies on statistical distributions, reversing large accruals, and projecting cash effects via algorithms. This method requires a good deal of data and statistical skill, and is best utilized for mid-term forecasting (unlike the direct method, which is much better for a shorter time frame). The advantage of this method is that it is often accurate to the day or week, enabling high accuracy.

Budget Forecast Example

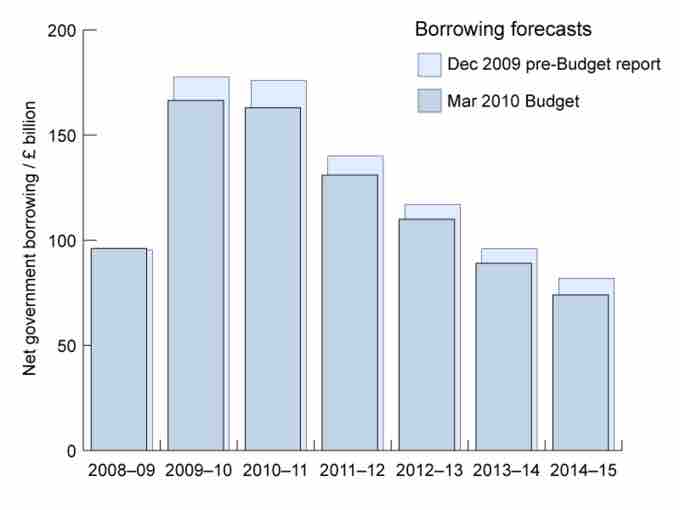

This chart demonstrates a forecast budget to the reality of what actually occurred. Budgeting is an estimation, often adjustments over time.